Why the Idea of Taking a Mortgage in a High Interest Regime is a Terrible Decision.

This Four Part Knowledge Series on Mortgages is based on a recent Twitter Mortgage Thread. You can comment on it and interact with me in Real Time Here.

Part A. Unsustainability of a Mortgage:

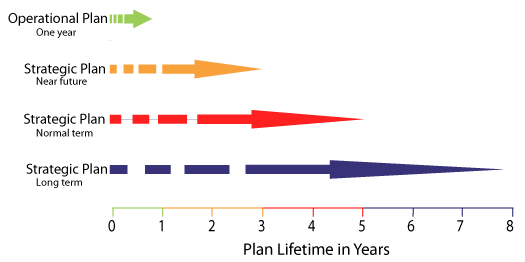

a) Unreasonable Terms: Under our interest rates regime and volatile market, the question, “Should i take a mortgage?”, “Is up there with, “Is there Life After Death?”. The ideal strategic planning timescale is 3 to 5 Years. How people convince a mere mortal to take a 25 to 30 Year Mortgage is a Mystery!

The planning period is important because it is an indicator of the Exit Plan. For example, The Mombasa-Malaba Standard Gauge Railway loan from EXIM bank has a 2% interest per annum with a grace period 7 to 10 years. Commercial loan has similar periods. It is also interesting to note that when you compare Mortgage and Life Spans, you find that the life expectancy at birth in Kenya is 63.52 while that of a cheetah in the wild is 10 to 12 years. This implies that Three generations of Cheetahs would have been born before you finish paying that mortgage. And technically half your “expected life.”

b) Hidden Costs: “Hidden” Mortgage Costs Can exceed 10% over and above the Mortgage Rate! When signing up, you may not be aware of Additional Charges. Beware, Hidden Mortgage Costs Can exceed 10% and Most of Our Banks don’t make full disclosures!

Examples of Hidden Mortgage Costs are:

- Valuation/ Realtor Fees can be as high as 3%

- Account Opening/ Origination Fees – Between 1 to 2%

- Booking Fee – You may or may not qualify when you apply

- Cost to register a mortgage and title transfer (4.35% of property value )

- Stamp Duty and Registration Fees Approx. Ksh. 45,700

- Mortgage protection policy premium. – You have to take additional insurance cover.

- Legal Fees for Processing the Mortgage Fees. Will depend on Lawyer/ Bank. Usually non-negotiable

- Property Tax

- Commisions

- Broker Fees

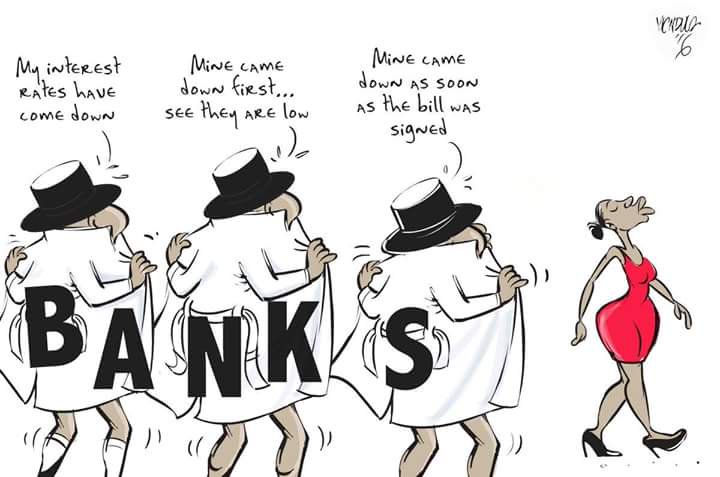

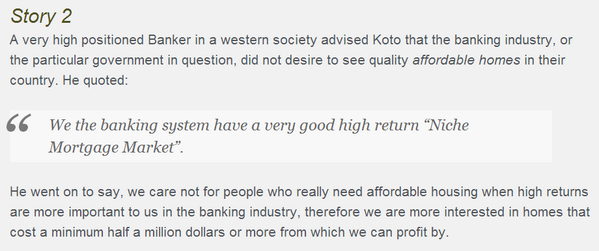

c) Banks are Not Interested In Affordable Housing: It is an Open Secret that Banks are NOT INTERESTED in the Affordable Housing Market for the sake of it unless there is a Killing to be made in fees and hidden charges. According to One Government that spoke to KOTO here:

“We the banking system have a very good high return in “Niche Mortgage Market”.

The Question is, “What is the SIZE of said MARKET in Kenya?” The lucrative Niche Mortgage Market in Kenya is approximately 1%.

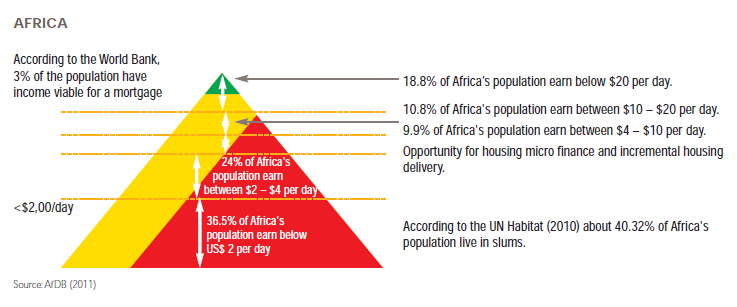

According to the World Bank, 3% of the population in Africa have income viable for a mortgage.

You can say this is a conversation we, the 99%, are willing to have with ourselves. We are not in the “Niche Mortgage Market”.

d) Age Limitations on Mortgages: If you are 35 Years+, remember that a mortgage is a type of loan with a definite repayment period. Typically Loan Maturity cannot exceed retirement age. Since most mortgages are for 25 year terms, soon you will permanently NOT QUALIFY on account of age limitations.

e) Over-Purchasing: When you sign up to a toxic mortgage, you are buying more house than you can afford but over a longer period. Most are Toxic anyway! Technically, That is a bad decision UNLESS your monthly mortgage payment is less than 25% of take home pay.

f) Stolen Opportunity!: According to Knowledgeable Experts, A 25 to 30 Year Mortgage Steals Your Future! Blog:Your “Stolen” Opportunity

g) Other Nations started early. We are doing too little too late: It is a bitter fact that we are late on the Home Ownership program. One can almost say that it has been Policy since 1963 that housing should be Un-Affordable! The mere lack of demonstrable effort proves it is. Property Owning was supposed to be on the Transformation Agenda since 1963.

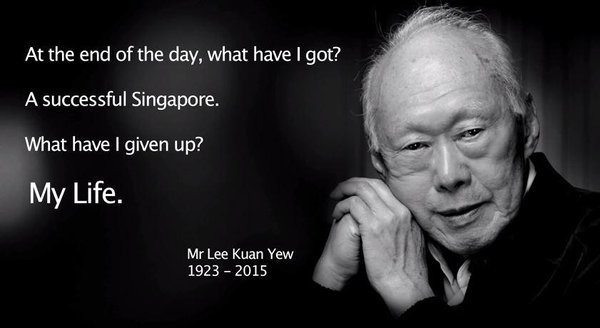

When you consider the work of Other Countries and their Founding Fathers, you quickly learn there was exactly NOBODY to take the Bullet for Us! Nobody actually cared about the question of Affordable Housing or Affordable Mortgages.

We like comparing Kenya to Singapore during campaigns. It is good to know the vision of Lee Kuan Yew was a 100% Property-Owning Democracy. According to Parliamentary Debates of Singapore Volume 45, Col. 1140, it is recorded:

“Lee said the Government’s aim “is to try and get a unique society set up out of extraordinary circumstances, of near despair, to become a 100% property owning democracy.”

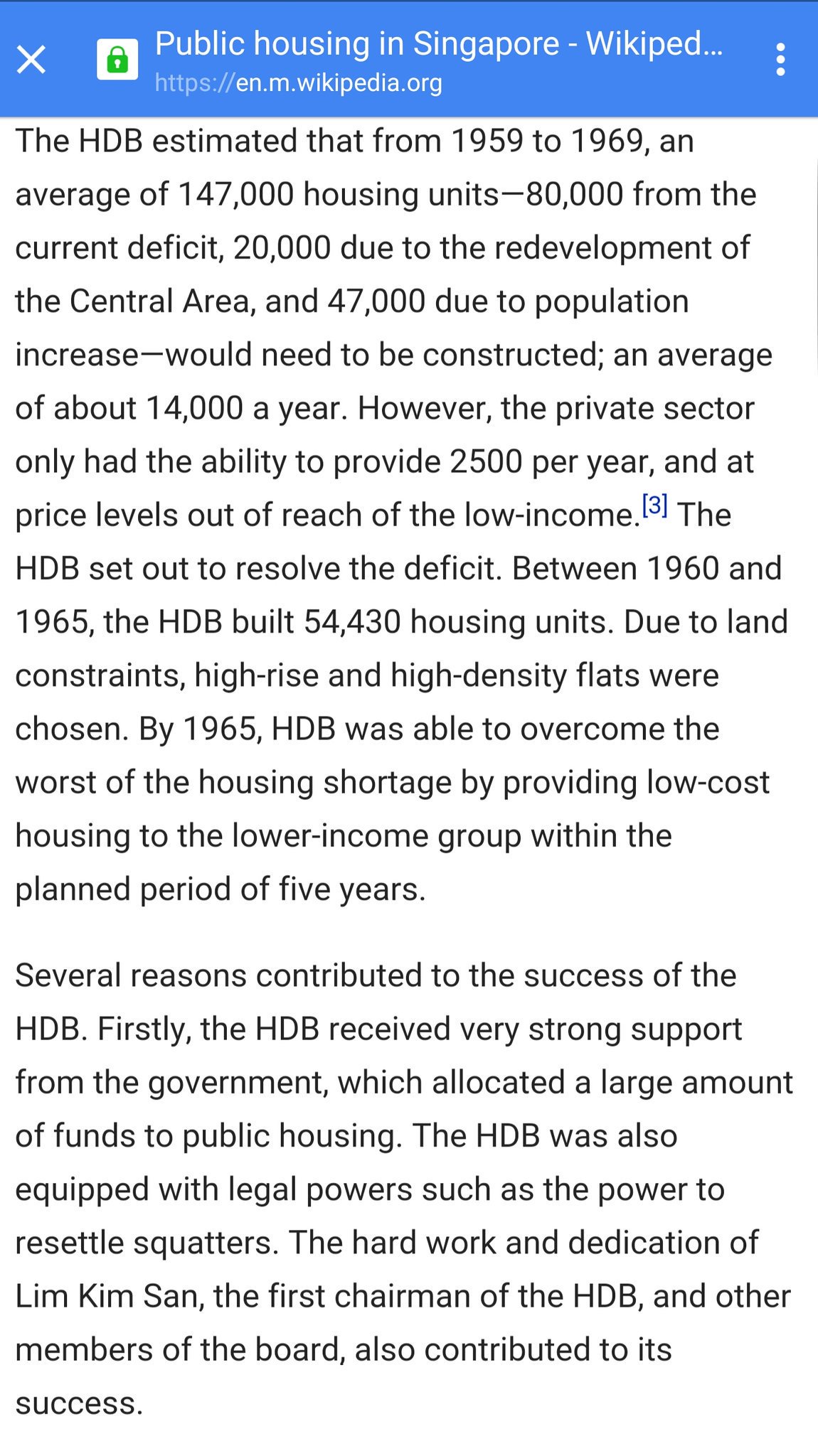

In Kenya, we are held at ransom by the Lands Cartels and the Bankers! There is no Visionary like Lee among the people! Here is a slight preview of Singapore at he Vision of their Founding Fathers:

2. Public Housing in Singapore – Wikipedia Article

End of Part A.

Part B. Seven Myths on Mortgages.

Part C. Seven Reccomended Cures for a mortgage.

Part D. What my friends and Other Experts THINK concerning Mortgages.