How To Think And Build like a Real Estate Investor (With a Simplified Worked Example)

Introduction

Money is made or lost in real estate before a house is built. The decisions that determine the outcome are made at the beginning. These include the Vision to Build(Why?), the Design (What?), the Costs summarized in a Bills of Quantity(How?), the Location (Where?) and the target Market (Who?). Here is how to build while thinking as an investor:

Build to Rent

By Self: Rent to Own

If your annual rent is higher than the cost of owning land plus building a small office, then build and use the savings to offset the cost of development. It is possible to find good land in Peri-Urban Areas near main Cities.

This will allow you to start your journey of owning a small office and eventually a bigger office complex as you complete your Rent-to-Own Milestones. In this scenario, you build a house and move in so that you can stop paying rent but pay down the loan used to build the house or office. Caution: Do not be too quick to move out of major Cities since some Opportunities are more concentrated in Cities than Rural Areas.

By Others: Rent for Profit

Becoming a landlord is a worthy goal when thinking about building. There is always pressure created by increasing household sizes and there will always be persons willing to rent if the location and price is right.

The main factor to consider while thinking about rental properties is affordability, Location, Services and The Payback Period. In Other Words, will your tenants be happy? and will you be able to recoup your initial investment by collecting rental income? One should also consider the prevailing rental income of the location and whether there are Opportunities for growth. For example, Universities and Hospitals can be great source of constant clientele.

Build to Sale

When Building to Sell, the most important factors are Location, Affordability and Profitability. One needs to consider all the costs of the project including Value of land, Financing Costs, Consultancy Fees, Cost of Statutory Services (Electricity, Water and Sewerage) and then determine the Selling Price. The metric to study will be the return on Investment (ROI)

Worked Example with a Financial Template

Financial Template:

In the above example, we are looking at a Potential Development of an Apartment Block Comprising of 8 Residential Units with shared services (Parking, Play Area, Common Staircase et Cetera).

As the numbers show, we have only two factors to consider, the input costs and the revenues. A difference of which will either generate a Profit, Loss or Rental Income with the indicated Payback Period.

All the Variables in the template are adjustable such that one can do further analysis on different neighborhood, House Types, Project Type e.g. An Industrial building or Park et cetera.

The most important thing to remember is that money is made or lost before a house is built.

NOTES ON FINANCIAL TEMPLATE:

- The proposal is to build 2 Blocks in two phases or at a go if funds are available and allow some green area, parking, landscaping and a running track all-round the land.

- Item A: Cost of land is pegged at KES. 1 Million for each unit. A bloc will thus raise KES. 10,000,000 and Two Blocks of Apartments would raise KES. 20,000,000.00 towards the cost of land. The sum raised can be used to purchase subsequent land parcels for future developments. This figure can change depending with the final report from a Registered Land Valuer.

- Item B: Commitment Fees is sums paid for formal engagement of consultants and the Project Team. This is used towards making detailed feasibility studies of the proposed venture. This will also enable production of preliminary Concepts, Cost Estimates and a Master Plan. The Client can pay a minimum of KES. 200,000 and a maximum of KES. 500,000 to jumpstart this process.

- Item C: The Cost of Finance. Using the Concepts, Cost Estimates and Master Plan prepared under Item B, the Developer can secure a Loan Facility from lending institutions. The Cost of acquiring and processing such a facility is covered under Cost of Finance. This includes insurance for the facility, interest rates and processing fees. The lender will determine the Terms and Cost of Finance in negotiation with the Developer. Investors who put money into the project can also determine this as a return on their investment when the project is sold out.

- Item D: Professional Fees. This covers the fees for the Architect, Structural Engineer, Mechanical and Electrical Engineer, Quantity Surveyor, Landscaper and any other Specialist Consultants engaged by the Project Team to ensure the integrity and successful implementation of the project to completion. It is paid in pre-agreed stages until project completion and covers both Design, Inspections and Supervision.

- Item E: Preliminary Costs. These are costs which are incurred either as a statutory requirement or as a matter of necessity to make the e.g. Hoarding, Signboard, Project registration, Insurance for the Works, Sanitation for the Works, Water and Electricity for the Works, Security et Cetera. They may not form part of the final works but they are a necessity for the successful implementation if the project. They will be particularized and priced.

- Item F: Construction and Training Levy are mandatory sums payable to the Government on any ongoing or proposed project and may change from time to time depending on legislation.

- Item G: Renewable Energy Component. Studies indicate that Green Buildings and those which are designed and built with environmental consciousness attract more rental income and can be sold at a premium thereby increase their uptake in the market. This cost shall be covered by the Renewable Energy Component which includes Solar Water Heating and Lighting

- Item H: ICT Component is to make the building compatible with ICT Technology including charging ports, CCTV Surveillance, Security Installations, Conduiting and wiring for gadgetry.

- Item I: NEMA + Levies 1%. According to the Environmental Management and Coordination Act(1999), we will require to obtain a license from NEMA after an expert has undertaken an Environmental Impact Assessment of the Project.

- Item J: External Works Cost (Drainage+ Septic tank+ Water Storage). The Foul Drainage, Septic Tank and A Soak Pit will cost each dweller approximately KES. 300,000.00 as there is no Public Sewer near the project site. Each house will thus contribute this sum towards foul drainage and water storage tanks or Tower.

- Item K: Project Manager. There is need to coordinate the Project Components, Expectations and Delivery during the lifetime of the project from start to finish including period where the units will be under sale. This is usually done by the Construction Project Manager

- Item L: Marketing Cost. This cost is important to ensure there is speedy uptake of the housing units and to gauge the correct pricing point. It also includes cost of covering target market survey, advertising, billboards, social media campaigns, Print and Voice Advertising and any other Marketing Activities geared towards the success in the uptake of the project.

- Item M: Cost Per Unit: With Item A to K covered, the cost of building one residential unit will be 7,724,673.16 This cost is reasonable. More items can be introduced or removed depending on the overall target audience

- Item N: Projected Sale Price: The Developer is at liberty to sell the project at any cost. However, should the units be sold for KES. 15,000,000.00, it is projected that the Developer will realize a Net Revenue of KES. 150,000,000 for the 10 units. The Market Analysis generated from Market Research will provide the Best and Worst Case scenarios and the correct selling price.

- Item O: Cost Per Square Metre. This is the all-inclusive cost per square metre used to estimate the cost of building a similar unit in the neighborhood/ same land e.g. as Phase 2 or 3.

- Item P: Net Profit is what is realized after the Total Cost of the project as been subtracted from the Total Revenue.

- Item Q: Percentage Return on Investment (ROI) activities comparing what has been invested and what has been realized as profits. In this case, it is 94.18%. Selling the units at a higher price would raise the ROI and increasing the input costs would lower it subsequently.

- Item R: Rental Income. If the 10 Units as designed, are released to the market as rental properties, they will be able to fetch KES. 500,000 per month. This item will also vary depending on the Market Research and Feasibility Study.

- Item S: Total Annual Rental Income is the total sum realized from rent from the housing units built.

- Item T: Finally the Payback Period means the time it will take for the Developer to get back 100% of his initial investment if the Property is let out at the Proposed Rents. This is 10.73 Years using our analysis. The higher the rent, the shorter the payback period and vice versa

COST SAVINGS

- The floor area of the house is a major constraint in trying to lower the cost of the house. Our Key Assumption is that we shall design 3 Bedroom Houses in the range of 90 to 100 Square Metres

Maximizing Rental Income by Design

Example 1

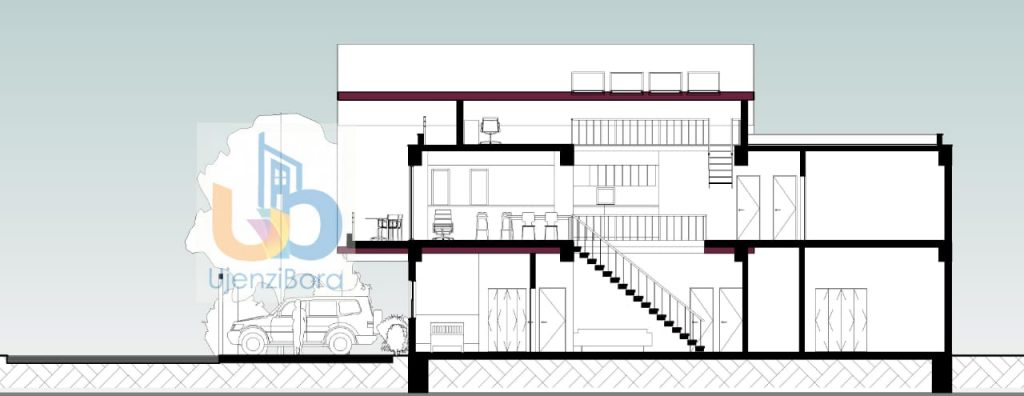

Because the primary driver of an investment decision is to obtain a Return on Investment(ROI) or Make Profit at the shortest time possible, below is an example of a Proposed Residential Housing Unit that Maximizes Rental Income.

In the example, we are working with an 8No. Bedroom Maisonette where the following scenarios can play out to maximize Returns.

- Owner can rent out each of the 8 Units bedrooms as an AirBnB or Hostel for near a busy institution.

- Owner can rent out the first floor as a commercial Kitchen and Lending Library to two different vendors or Build and Operate them as Such

- Owner can rent out the upper attic floor as a Gym for the Residents and people in the neighborhood.

This is a House designed with the idea that it is an income generating machine. It is meant to get the owner to their financial goals within the shortest time possible.

Whereas this is one scenario, there is no limit as to what Solutions can be Designed to meet various Financial Goals.

(Nobody has the luxury of time, and those who wish to solve the pressing problems of others are prudent to want to obtain their initial sum invested as soon as possible)

More Examples to Follow**