Leveraging the Housing Value Chain To Meet Housing Demand

It was Archimedes that said, “”Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.”

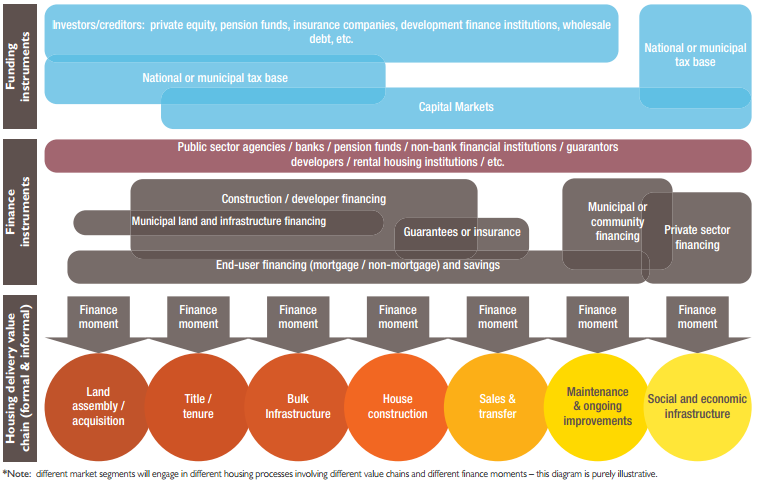

We have clearly identified in previous posts the pressing needs of our time in providing affordable housing and accommodation. However, in order for us to make a dent on the issue of housing deficit, we must consider all the factors in the housing value chain and leverage those that will cause the greatest impact in provision of housing.

A value chain is a chain of activities that a firm operating in a specific industry performs in order to deliver a valuable product or service for the market.

Today, 40% of the continent’s one billion people live in cities, compared to 28% in 1980. By 2030, this is projected to rise to 50%, and Africa’s top 18 cities will have a combined annual spending power of US$1.3-trillion. The housing market is set to undergo a shift as major players are re-aligning themselves to the new realities of urbanization and the housing deficit.

For example, we have seen Housing Finance launch Ezesha Mortgage Product that enables aspiring homeowners access up to 105% financing with a view to cover 100 percent of the property cost, stamp duty and the professional fees. And 5% to cover closing costs with an additional offer of providing a Ksh.500,000 loan for furniture and fittings.

Hard Economic Times and Timers

There is broad recognition that some Kenyans are facing hard economic times, but one must ask themselves whether an easy entry into the Mortgage Industry would translate into meaningful easing of the very pressure that one seeks to escape. If we make it easier for people who cannot afford the minimum requirements and load them with heavier loads, shall we make the initial deterrent disappear? Would it be better to find a solution that addresses both the short and long-term issues?

In the Ezesha Mortgage Product launch, Housing Finance Managing Director, Mr. Frank Ireri said

“One of the major stumbling blocks to home ownership has been upfront payments such as the down payment, stamp duty, valuation and legal fees, which account for about 18 percent of the property cost.”

This brings me to my point.

The Housing Value Chain.

What are the other “stumbling blocks” to home ownership? Can they be turned into Stepping Stones?

You see, we live in a world where a basic human need like housing is becoming a man trap. Let me explain. If you are struggling to come up with a house deposit, could it be a sign that you will struggle with the Loan Repayments? Is the main thing Home Ownership or Ownership of you as the lucrative asset? If you are getting the land, the house, and the furniture on loan, you must be a NINJA. Related Read: Why The Idea of Taking a Mortgage in a High Interest Regime Is a Terrible Idea

What am i trying to say? There is more to home ownership than Finances. Here is How To Think Outside The Box

Robert McGaffin, director of the Housing Finance Course for sub-Saharan Africa at UCT’s Graduate School of Business (GSB) recently said that, “Finance products must match the needs and circumstances of the target population and need to be delivered in a viable manner. The recent global financial crisis and the unsecured credit crisis in South Africa highlight the dangers of poor lending practices, unsustainable business and funding models.”

The idea of the value chain is based on the process view of organizations, the idea of seeing a manufacturing (or service) organization as a system, made up of subsystems each with inputs, transformation processes and outputs. Inputs, transformation processes, and outputs involve the acquisition and consumption of resources – money, labour, materials, equipment, buildings, land, administration and management. How value chain activities are carried out determines costs and affects profits.

— Cambridge University: Institute for Manufacturing (IfM).

Sorting out the top structure financial constraints alone will not solve the housing challenge in Sub-Saharan Africa. Whether governments and institutions succeed in meeting the rising demand for houses and housing finance products in Sub-Saharan Africa will depend on the strength of each link in the housing value chain, that is:

- Land : Can we leverage land through co-operative ownership? Would it be better to develop further from the City? Can we consider housing other than “Residential Units” e.g. Owning Tourist Facilities that would generate Revenue for home owners?

- Property rights,

- Infrastructure,

- Development rights,

- End-user households/Home-Owner,

- Investment, and

- Management.

Of all these things, the potential home-owner is the most important element in the Value Chain.

Housing Finance has made a very impressive move that will help us leverage finance, but we must move with speed so that we bring down the Cost of Housing such that even if someone is signing up for a 105% Mortgage, they are signing up what will not choke them later. We must fuel sustainable growth and not just dumb growth where we shift the wealth on the balance sheet without Creating New Enduring Value.

This is also a call to the other major players in the Housing Market to leverage their skills and expertise to enable the family of man solve the housing deficit problem in Sub-Saharan Africa. Architects, Engineers, Land-Owners, The Government, Political Parties, The World Bank….each and every one of us. We must not only leverage the Financing but also the Thinking, the Architecture (Affordability/Sustainability) and the entire Housing Value Chain.

Last Word

Even as we continually seek solutions to the housing deficit challenge, my sincere advice to you is that when you go to the market, do not let your Signature be an instrument for selling your Soul.

Tafakari Hayo

– Qs. Nahinga David