The African Courtyard House by Architect Glenn Wilson

In keeping with our value proposition of providing affordable housing solutions, we are pleased to introduce The African Courtyard House designed and conceptualized by a team of designers led by Glenn Wilson Boerstler and Ujenzibora Investment Ltd.

In the year 2013, we set out on a journey to create a series of affordable housing solutions to be implemented in our “Design & Build Package”. We launched the Firstep House: Affordable Housing for Every Beginner as a first in the series and The African Courtyard House becomes the third deposit after The Minima House.

Even though at first we received minimum participation, The Ujenzibora Housing Challenge continues to receive excellent submissions.

Project Inspiration:

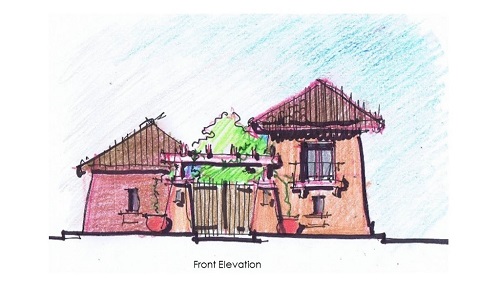

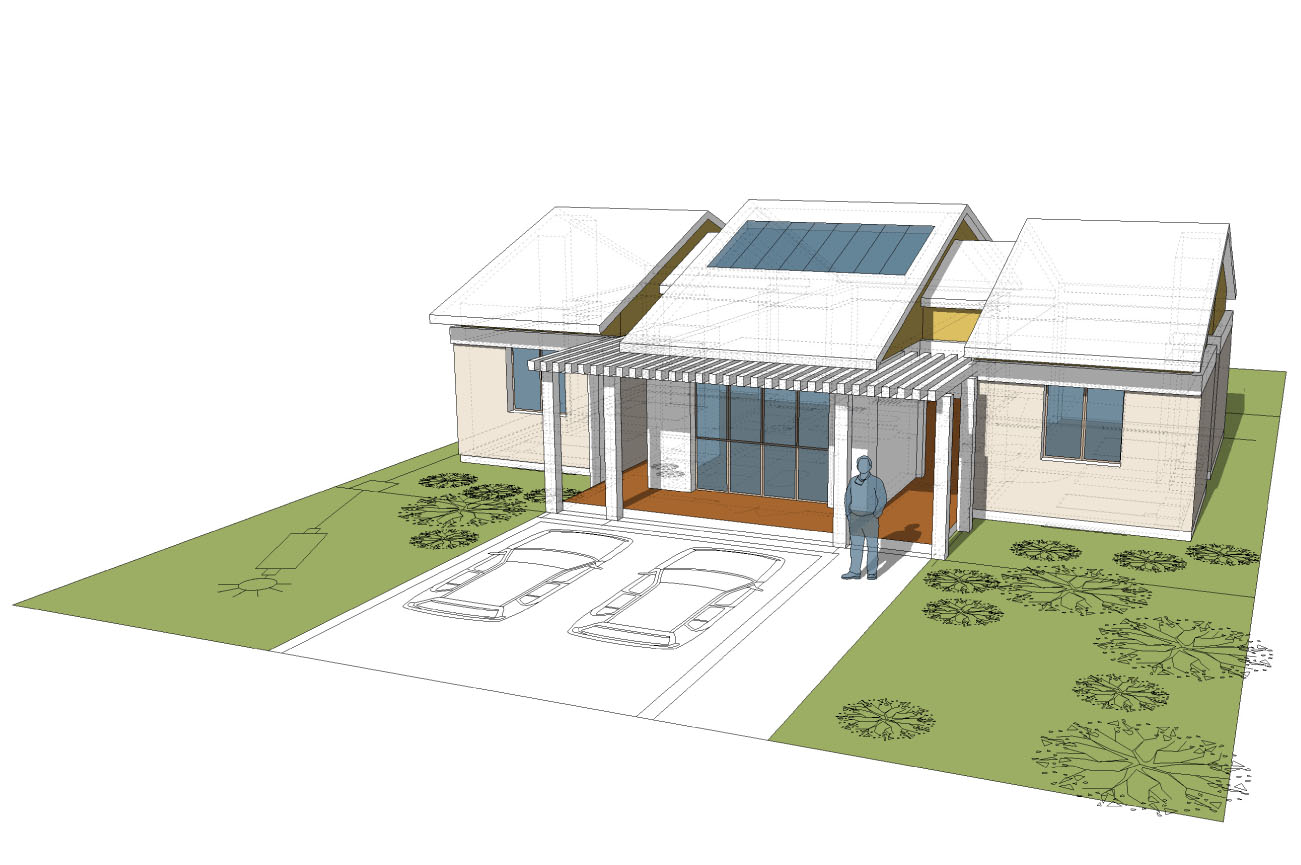

The first and most important concept explored in this design is the concept of shelter (shown through elements of African Architecture). I have chosen to design with this tradition in mind. The clean lines provide a modern aesthetic while the color and materials complete the link to the vernacular architecture tradition.

Proposed African Courtyard House (A ReThink of Vernacular Architecture fit for Rural Areas)

Courtyard Concept:

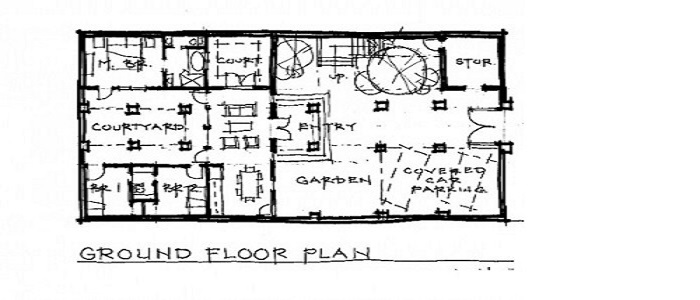

The house is based on a courtyard concept. There are two courtyards that represent the family’s social life as well as more private family functions and traditions. From the street entry one arrives through a wide plank wood gate by either by foot or car. The walls that surround the entire home are 3040mm in height. The entry courtyard provides sheltered car parking, a formal public courtyard, enclosed storage at the base of the tower and access to the guest bedroom and bath above.

African Courtyard House : Ground Floor Plan

Directly on axis to the wood entry gate is the main entry portico to the house itself. One enters the Great Room of the home which is a tall volume containing the Living Room, Dining room and Kitchen. The home is a bifurcated plan that encloses and inner private courtyard. This courtyard represents an outdoor Living Room accessed on three sides.

The other two arms of the house include the bedrooms. To one side of the courtyard is the Master Bedroom Suite. The Suite includes a master bath with views into a private courtyard. The other arm includes two smaller bedrooms with a shared full bathroom.

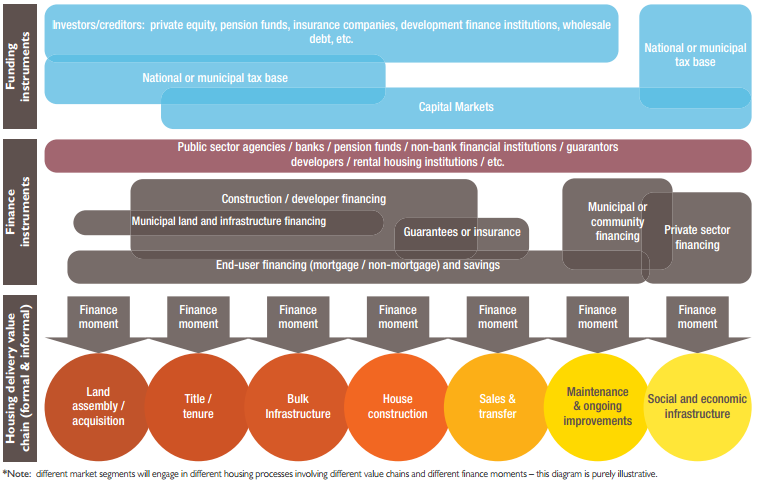

In our “Design-And-Build” Package, we have removed the complexity costs and process which have proved to be very tedious and confusing to home owners. For people who already have Land and Clean Title/Ownership Documents, to Construct The African Courtyard House the payment terms are as follows:

1. Committment Fees – 8% of Building Cost – Contract Signing & Design Modifications

2. First Installment, Second and Third Installment – 60% of Building Cost – Construction up to roof level

3. Last Installemnt – 32% of Building Cost – Complete Construction

The installments can be varied in agreement with the client.

Upon project completion, the owner gets a Hand Over Report and As-Built-Drawings which can be used later for property valuation, history or referencing.

Message from Architect Glenn

“Thank you for the opportunity to participate in this. I enjoyed the cultural aspects and African vernacular architecture I researched. A few of the results of this research are posted as inspirations for you to share in the development of the concepts presented herein.

Again, thank you for posting this exciting competition for my colleagues and I to design. I sincerely hope that you find the results you have expected and hoped for. The process of working on this home for you was very gratifying and informative. A note on my graphic approach. I became an architect because of my interest in the arts, in particular drawing. Drawing is an important component of my design process. I hope the graphics adequately illustrate these ideas.”