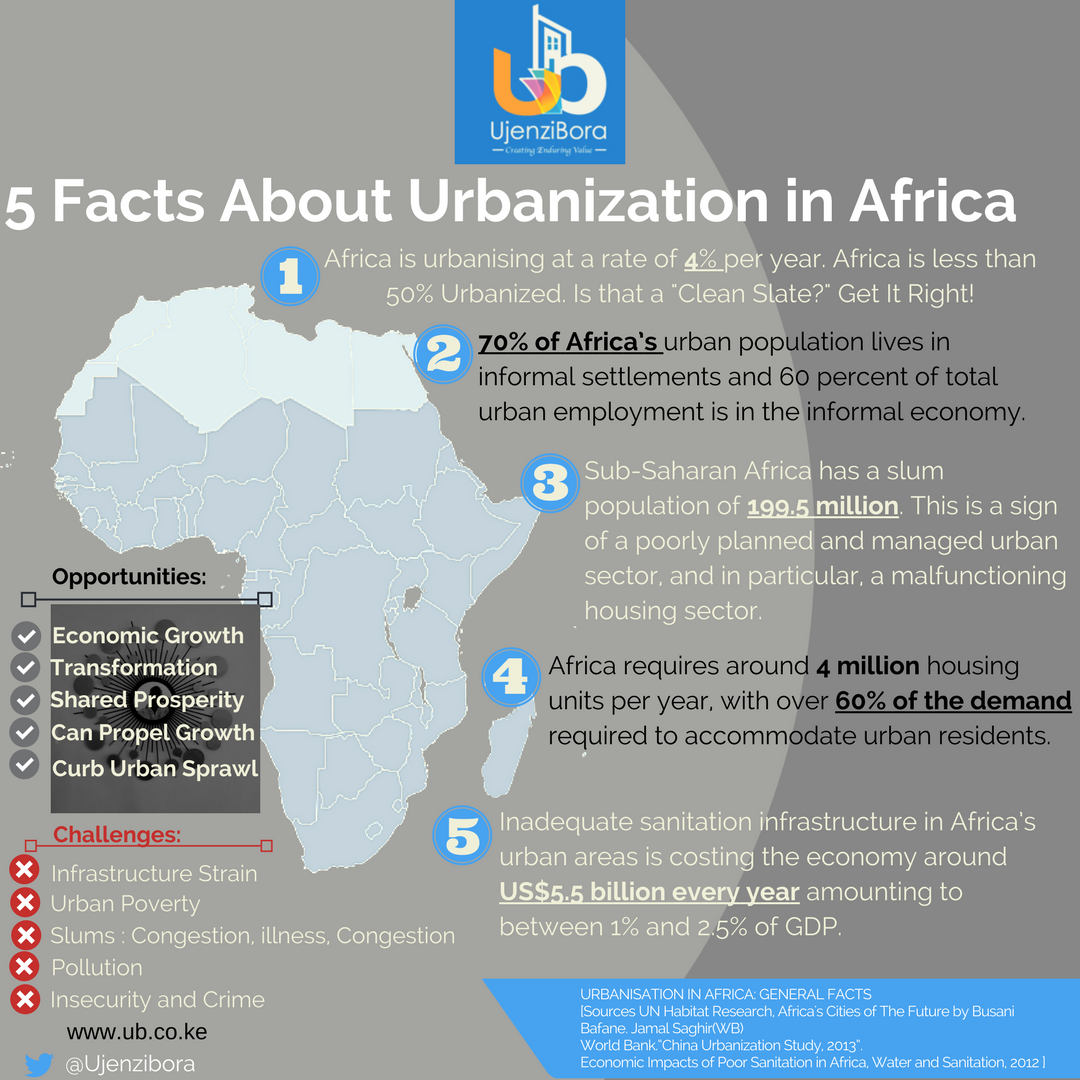

5 Facts about Urbanization in Africa and arising Threats and Opportunities.

Rapid Urbanization:

More than half of Africa’s population will live in its cities by 2040. This translates into a population growth of more than 40,000 new urban inhabitants per day between now and 2040.

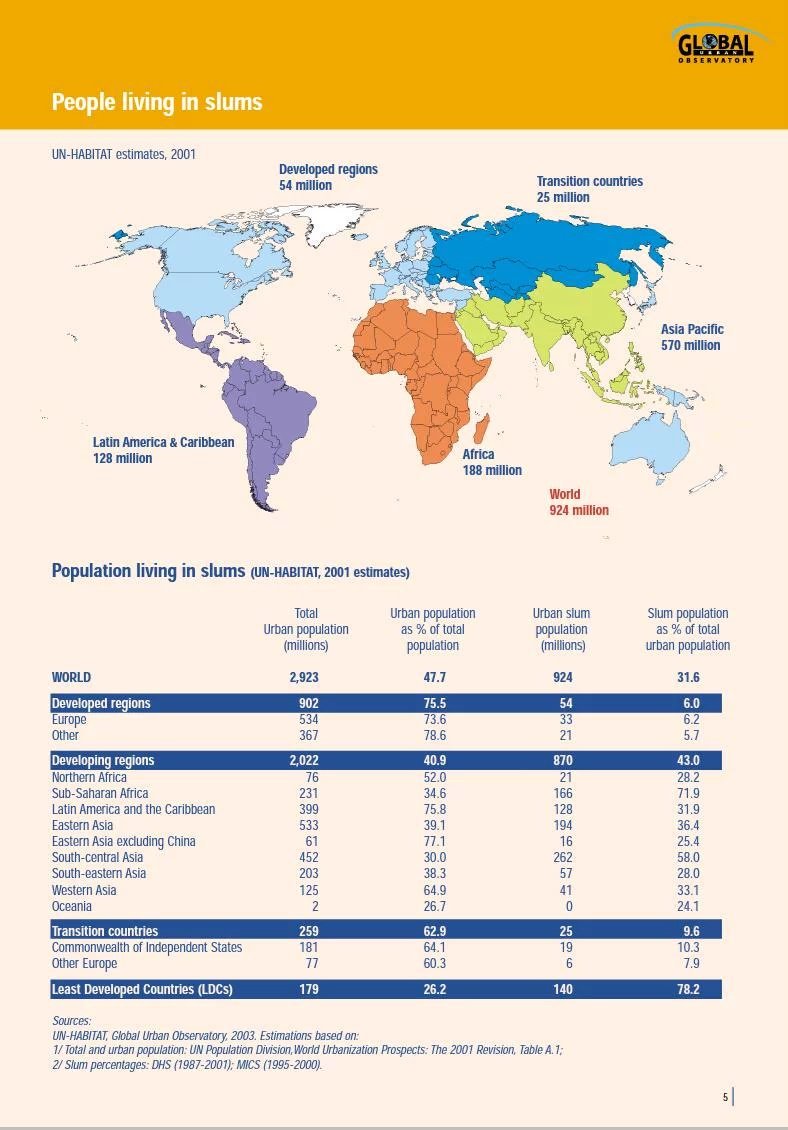

With an exception of Seychelles, 71% of urban population in sub-saharan Africa live in slums. In his 2014 World Habitat Day Speech, Seychelles Land Use and Housing minister Christian Lionnet said,

““In Seychelles, since the early years after independence, the government has adopted a pragmatic and consistent approach to housing development based on strong socialist principles. Special vigour has been put on long term programmes for appropriate solution in tackling our housing shortages. The government has remained focus on its aim to reach a position where the laws of supply and demand come into play fairly. Today, over thirty years down the line, Seychelles’ ultimate aim for housing is not only to facilitate access, but for every Seychellois to own his or her house.Figures from the last Population and Housing Census (2010) reveal that in 2010, 71% of families in Seychelles own the houses they are living in. This make Seychelles ranked among the top countries in the world on par with the developed nations.”

71% of the population in Seychelles own their homes. Over 450 million new urban dwellers are expected between 2010 and 2040, with half of Africa’s population living in urban areas by 2040. This presents various Threats and Opportunities depending on the level of preparedness of Cities.

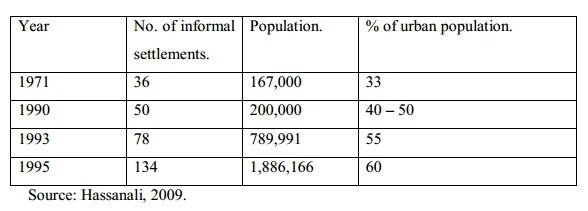

In Nairobi, between 1971 and 1995, the percentage of the urban population living in slums almost doubled to 60%

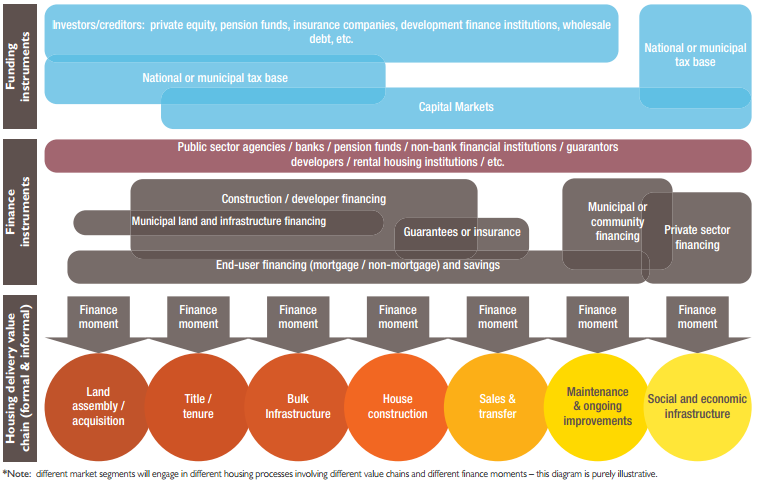

Cities are Engines of Economic Growth and in that sense, must prepare to take centre stage of Rapid Urbanization. There are three main enablers to enable Cities generate economies of scale advantages. Urbanization alone is not sufficient to regenerate the Cities of Tomorrow. They also require:

1. Public investment in infrastructure. There is need to reform policy and legal framework for better integration of city planning and management.

2. Enterprise investment in productive capital. Enable businesses to create quality jobs for people moving into urban areas. This will enhance the ‘Working Environment.”

3. Household/private investment in housing. Strengthen institutions and systems that make cities competitive and sustainable. This will enhance the ‘Living Environment.”

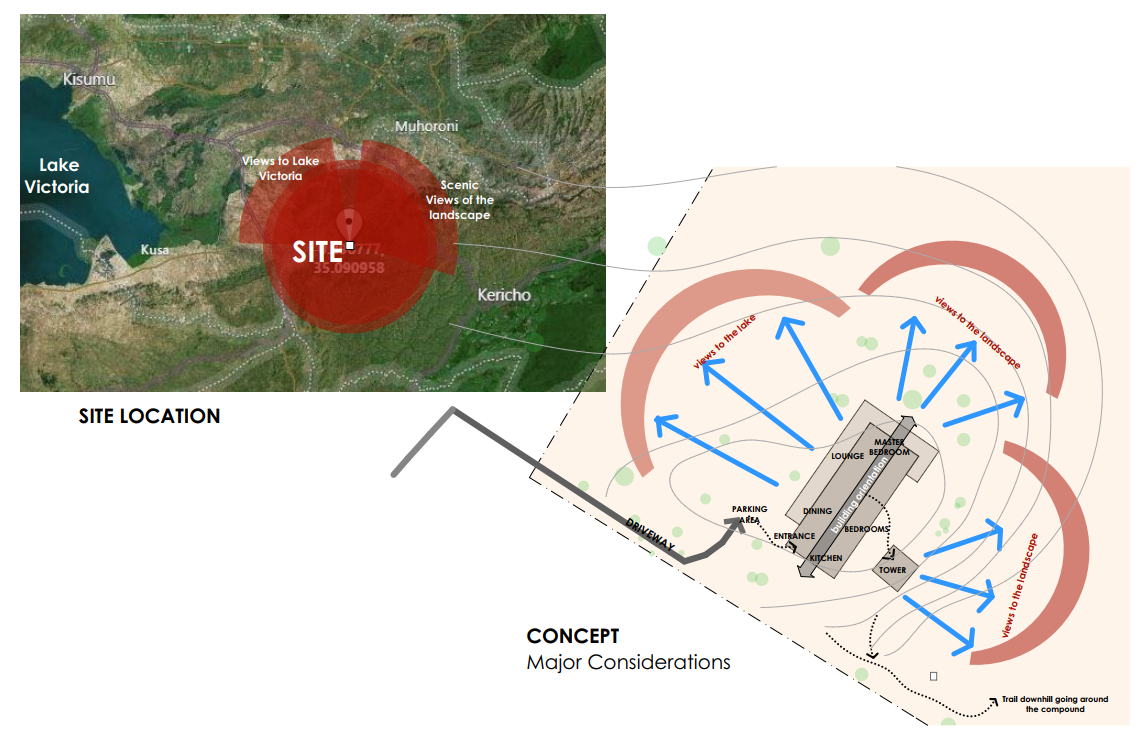

If people have opportunities for income, work productivity, opportunity for recreation and socialization with quality housing and access to both the Work Environment and Living Environment, Urbanization is a welcome.

This is an opportunity for entrepreneurs and the Government. Apart from attracting productive capital, cities attract and galvanize entrepreneurs. Studies show that 80% of global economic activity is generated in cities; activities that benefit from density and proximity—of goods, people and ideas.

Infrastructure Investment Lesson from China:

According to the World Bank, In 1980, the urbanization rate in East Asia was similar to that of South Asia and Sub-Saharan Africa. Between 1980 and 2010, the rate of urbanization doubled in East Asia to 50 percent, and the urban poverty rate decreased from 24.4 percent to 4.3 percent.5 By contrast, in Sub-Saharan Africa, where the urbanization rate increased from 23 percent in 1970 to 37 percent in 2011, urban poverty decreased only marginally from 41.5 percent to 33.6 percent.

If Rapid urbanization is well managed, it can curb urban sprawl, deteriorating access to services, greater inequality, and increased crime.

Boost Capital Investment:

China boosted its capital investment (including infrastructure, housing, and office buildings) from 35 percent of GDP in 1980 to 48 percent in 2011, while seeing a dramatic increase in urban population from 18 percent in 1978 to 52 percent in 2012. In contrast, capital investment in Africa has remained around 20 percent of GDP for over 40 years. China’s transformation was led by its cities, aggressively boosting investment and job creation by attracting low-skilled manufacturing industries that benefited from economies of scale and access to markets.

Informal or unplanned and under-serviced settlements are a common feature of many cities.In many cities, increasingly high levels of congestion, pollution, illness, disease, crime and insecurity add a huge burden to the economy through lost time and opportunity.

Inadequate Infrastructure is a Threat:

- Inadequate sanitation infrastructure in Africa’s urban areas is costing the economy around US$5.5 billion every year amounting to between 1% and 2.5% of GDP.

- 70 percent of Africa’s urban population lives in informal settlements and 60 percent of total urban employment is in the informal economy

- Countries with more than 60% of their population living in urban areas are expected to achieve 50% more MDGs on average than those with urbanization rates of 40 percent or less.

- In the next 20 years, cities in the developing world will triple their built-up area (from 200,000 to 600,000 square kilometers) and double their population (from 2 to 4 billion). What will happen in Africa if we continue to under-invest in Infrastructure?

Sources: Jamal Saghir, World Bank. World Bank:“China Urbanization Study, 2013”. Economic Impacts of Poor Sanitation in Africa, Water and Sanitation Project, 2012