httpss://twitter.com/UjenziBora/status/820971727849160705

It is always better to keep the building project within your financial expectations without compromising its integrity. This article is not about building a “cheap building” but Management of Costs irrespective of the size or budget of the project.

The beauty of managing costs is that resources are not wasted and whatever is left can be used on other aspects of the building like landscaping or enhanced security.

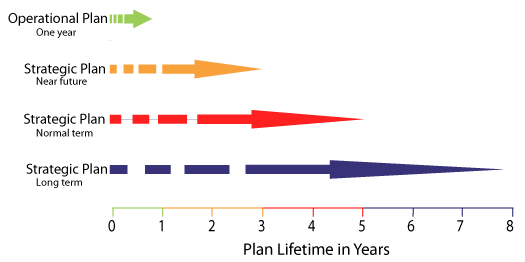

1.0 “Manage the project within a Construction Process”

In building a house, there is a messy process and there is the right process of doing things. The easiest way to have cost-overruns is to be dis-orderly.

Management creates order in the building process. The right process helps one to:

Control the Risks.

Control the Design.

Control the Labour Costs.

Control the Overheads.

You will have an upper hand if you have the benefit of foresight, planning and management. You require a program of works and a Method Statement for the Project. This will save you time and money. Don’t just build as if you are cooking “fufu”.

Have a plan and a process in place before starting the building project.

2.0 “Optimize your building site”

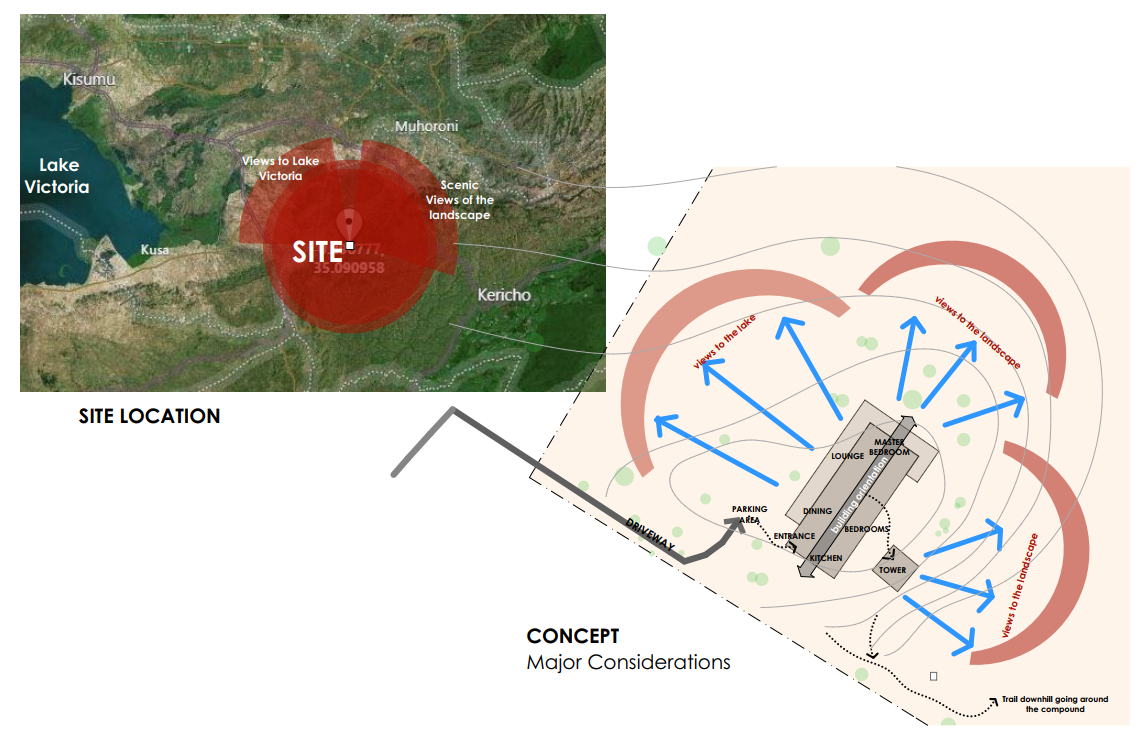

You need to plan the house with a clear view of site conditions. Don’t “copy paste” designs from one site to another even if the user needs are the same.

Simply, cut your coat according to your cloth:

i)If you don’t have much level ground, design a house with a small footprint (ground cover).

ii)If your site is sloped, consider doing a basement instead of spending money on cut and fill.

3.0 “Story buildings are relatively cheaper”

Suppose you have a 1500 square meter house all spread out on the ground and a three story house with each floor covering 500 square meter , which one gives you more value for money?

i) Roof Cover- In our example, for the same amount of floor area you spend less on roof covering.

ii)Foundation Costs – In our example, for the same amount of floor area you spend less of foundation costs and ground preparation.

iii)Savings on land are realized by building vertically.

Clearly, stacking saves one money when building. However, this option is limited by the zoning laws and regulations of the City Council or County/Municipal Council.

4.0 “Simplify the Design”

Leornado Da Vinci is quoted as saying, “simplicity is the ultimate form of sophistication.”

Yes! Take more time in the design stage of the construction. Be realistic and practical when drafting the Design Brief. A more complex design will cost more.

A complex roof-line with excess ridges and valleys will add to the time and cost of construction.

Let form follow function. Think about the maintenance cost of every material forming the fabric of the house.

Remember, for every building fitting or material, there is an alternative maintenance free material. Cheap is expensive, therefore Buy Quality to minimize cost-in-use.

To reduce on the building cost, you can avoid curved rooms, curved walling and overly sophisticated designs without compromising on the aesthetics.

5.0 “Consider Open Floor Plans”

You do not necessarily need a solid wall separating the kitchen, the dining and the lounge. You can partition using half a wall. You can also opt to have an open plan between the three spaces (Lounge, Dining and Kitchen). Do a comparative cost-analysis of various options including making the lounge sunken to “define it.”

6.0 “Minimize Administrative Costs”

Have an on-site project office, a clerk of works and a store keeper to handle records as to building materials. Record management will help in minimizing waste, theft and anticipating periods for re-ordering materials or labour.

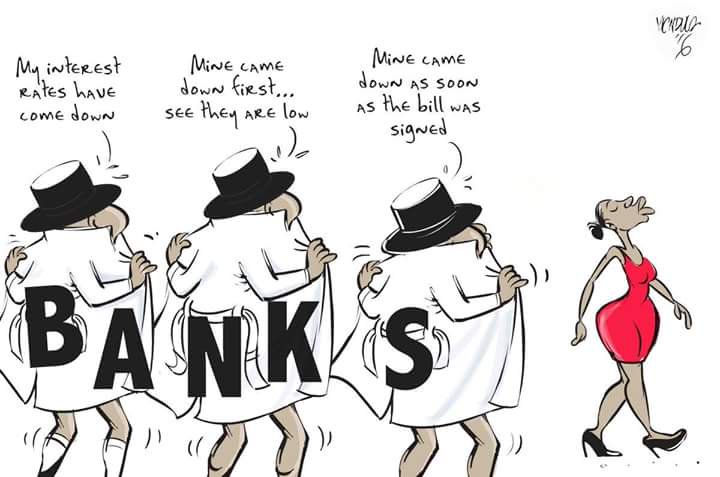

7.0 “Manage the procurement Process”

A crafty contractor may maximize profits by under-quoting on labour but offloading his profit ambition on procurement of materials.

Where do you source the materials and fittings?

Is it done competitively?

What are the alternatives?

You can save much by pre-ordering fittings and fixtures.

Have you considered imports for bulk supplies?

Consider that you can obtain a superior fitting.In case of large capital investments, one can have considerable quantity discounts by buying in bulk from the source, eliminating middlemen.

8.0 “Look at the House As An Extension of Yourself”

The best way to do this is to outline your role and key functions. Consider multi-use spaces and utilizing and creating space that would ordinarily not be in the normal houses. You will more enthusiastic about your house only if it reflects your aspirations. It is not ab-normal to have a house without a typical lounge or bedroom. Form follows function. Most people incur unnecessary costs building a house “like that of their neighbor.” For example, if you don’t like visitors, there is no point building a guest house if you are straining your budget! Let that money go into a spacious lounge or more elegant finishes.

9.0 “Do not Ignore Insurance”

The only way to mitigate certain risks is by Insurance of the works, workers and materials. Obtain a Contractor All Risk(CAR) Policy for the duration of works. Construction insurance provides safeguards for you as an employer against your construction workers being injured on site. Construction insurance does not exempt you from maintaining a safe workplace.

10.0 “Have a Contingency Plan”

This is money set aside for “unforeseen circumstances” which may eventually sink the building project if not taken care of. Also, have in place rules t spend the contingency fund. They include things like:

i) Inclement weather.

ii) Foundation issues

iii) Cost overruns from extended preliminaries, making changes, and encountering unforeseen design problems.

iv) Inflation and adverse Market conditions

SUMMARY: