Category: Decision Making

Why the Idea of Taking a Mortgage in a High Interest Regime is a Terrible Decision.

This Four Part Knowledge Series on Mortgages is based on a recent Twitter Mortgage Thread. You can comment on it and interact with me in Real Time Here.

Part A. Unsustainability of a Mortgage:

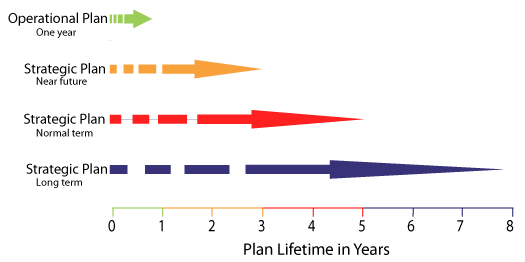

a) Unreasonable Terms: Under our interest rates regime and volatile market, the question, “Should i take a mortgage?”, “Is up there with, “Is there Life After Death?”. The ideal strategic planning timescale is 3 to 5 Years. How people convince a mere mortal to take a 25 to 30 Year Mortgage is a Mystery!

Typical Planning Timescale

The planning period is important because it is an indicator of the Exit Plan. For example, The Mombasa-Malaba Standard Gauge Railway loan from EXIM bank has a 2% interest per annum with a grace period 7 to 10 years. Commercial loan has similar periods. It is also interesting to note that when you compare Mortgage and Life Spans, you find that the life expectancy at birth in Kenya is 63.52 while that of a cheetah in the wild is 10 to 12 years. This implies that Three generations of Cheetahs would have been born before you finish paying that mortgage. And technically half your “expected life.”

b) Hidden Costs: “Hidden” Mortgage Costs Can exceed 10% over and above the Mortgage Rate! When signing up, you may not be aware of Additional Charges. Beware, Hidden Mortgage Costs Can exceed 10% and Most of Our Banks don’t make full disclosures!

Examples of Hidden Mortgage Costs are:

- Valuation/ Realtor Fees can be as high as 3%

- Account Opening/ Origination Fees – Between 1 to 2%

- Booking Fee – You may or may not qualify when you apply

- Cost to register a mortgage and title transfer (4.35% of property value )

- Stamp Duty and Registration Fees Approx. Ksh. 45,700

- Mortgage protection policy premium. – You have to take additional insurance cover.

- Legal Fees for Processing the Mortgage Fees. Will depend on Lawyer/ Bank. Usually non-negotiable

- Property Tax

- Commisions

- Broker Fees

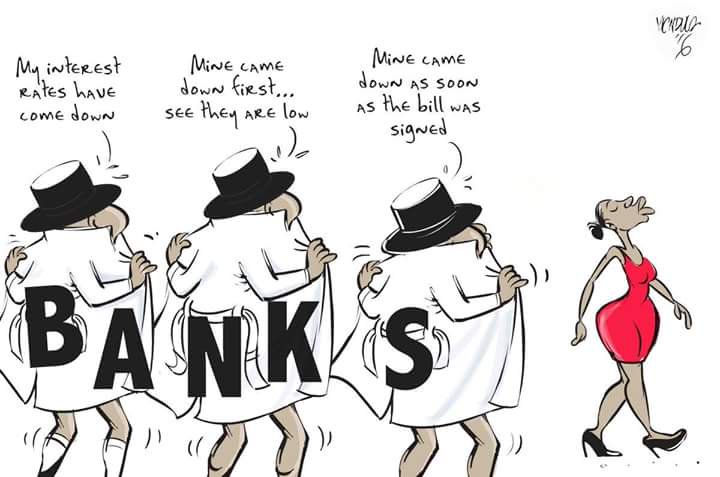

c) Banks are Not Interested In Affordable Housing: It is an Open Secret that Banks are NOT INTERESTED in the Affordable Housing Market for the sake of it unless there is a Killing to be made in fees and hidden charges. According to One Government that spoke to KOTO here:

“We the banking system have a very good high return in “Niche Mortgage Market”.

The Question is, “What is the SIZE of said MARKET in Kenya?” The lucrative Niche Mortgage Market in Kenya is approximately 1%.

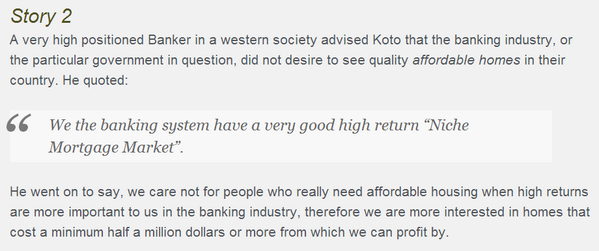

According to the World Bank, 3% of the population in Africa have income viable for a mortgage.

You can say this is a conversation we, the 99%, are willing to have with ourselves. We are not in the “Niche Mortgage Market”.

d) Age Limitations on Mortgages: If you are 35 Years+, remember that a mortgage is a type of loan with a definite repayment period. Typically Loan Maturity cannot exceed retirement age. Since most mortgages are for 25 year terms, soon you will permanently NOT QUALIFY on account of age limitations.

e) Over-Purchasing: When you sign up to a toxic mortgage, you are buying more house than you can afford but over a longer period. Most are Toxic anyway! Technically, That is a bad decision UNLESS your monthly mortgage payment is less than 25% of take home pay.

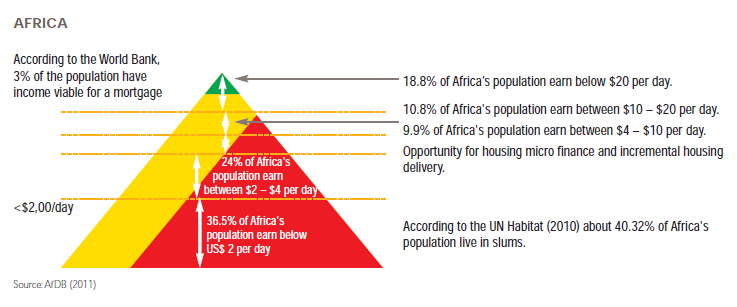

f) Stolen Opportunity!: According to Knowledgeable Experts, A 25 to 30 Year Mortgage Steals Your Future! Blog:Your “Stolen” Opportunity

g) Other Nations started early. We are doing too little too late: It is a bitter fact that we are late on the Home Ownership program. One can almost say that it has been Policy since 1963 that housing should be Un-Affordable! The mere lack of demonstrable effort proves it is. Property Owning was supposed to be on the Transformation Agenda since 1963.

When you consider the work of Other Countries and their Founding Fathers, you quickly learn there was exactly NOBODY to take the Bullet for Us! Nobody actually cared about the question of Affordable Housing or Affordable Mortgages.

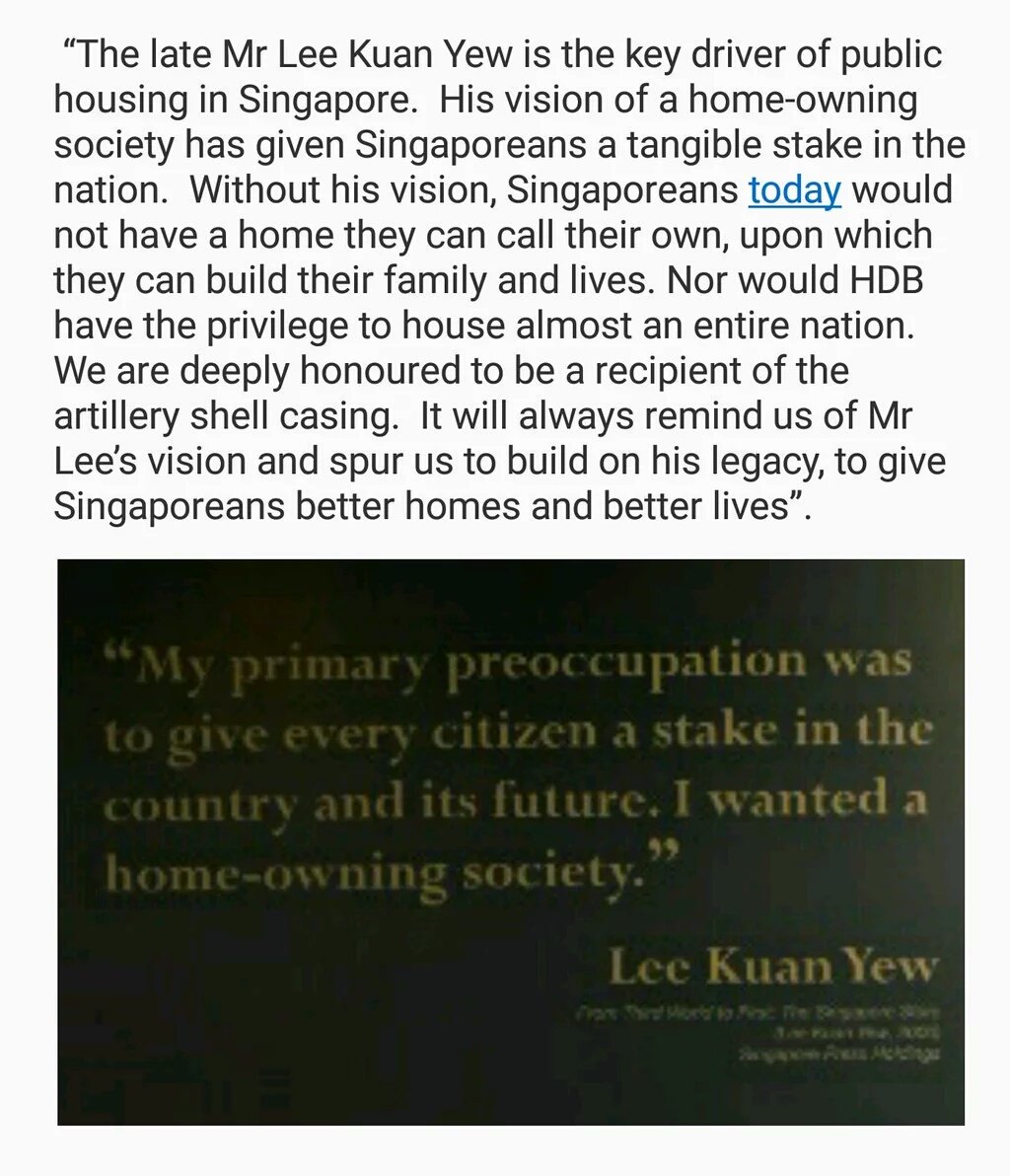

We like comparing Kenya to Singapore during campaigns. It is good to know the vision of Lee Kuan Yew was a 100% Property-Owning Democracy. According to Parliamentary Debates of Singapore Volume 45, Col. 1140, it is recorded:

“Lee said the Government’s aim “is to try and get a unique society set up out of extraordinary circumstances, of near despair, to become a 100% property owning democracy.”

In Kenya, we are held at ransom by the Lands Cartels and the Bankers! There is no Visionary like Lee among the people! Here is a slight preview of Singapore at he Vision of their Founding Fathers:

2. Public Housing in Singapore – Wikipedia Article

End of Part A.

Part B. Seven Myths on Mortgages.

Part C. Seven Reccomended Cures for a mortgage.

Part D. What my friends and Other Experts THINK concerning Mortgages.

Home Ownership through Self-Build

According to a recent survey by Kenya Bankers Association, those who could afford a mortgage are only 2.4% of the total population and 11% of the urban population. This is the case with an average mortgage loan size of Ksh.4.0million.

What does the law day about self-build?

The National Construction Authority Act 2011 provides in Section 16:

“a person shall not be deemed to be a contractor if the work undertaken— (i) does not incur a cost exceeding such sum or sums as the Board may from time to time determine; or (ii) consists of a residential house for private use, not requiring a structural design.”

The results of the survey indicate that home ownership is mainly through building (68%) compared to buying and inheriting which contribute 17% and 15% respectively.

The Minima: 1 Bedroom House by Ujenzibora

Key reasons for home ownership according to Centre for Research on Financial Markets & Policy, KBA

- Value as a lifestyle investment.

- Reduce the burden of rent.

- It has value as a way to build up wealth for retirement.

- To gain tax benefits/relief.

- Providing a good and secure place for the family.

- As an inheritance, it can be passed on to family.

- Need for a permanent residence.

- Owning a house improves ones social status.

- Secluded place/privacy.

- Gain place that is in a community and location you prefer.

- Privacy and seclusion.

- To accommodate personal taste and specifications.

- Ability to make updates and renovations if one wishes.

Is it possible to undertake self-build?

Yes it is possible. However, it is prudent to obtain guided service in the form of an Architect, Engineer, Quantity Surveyor and other such professional as one may need.

For supervision of the project, one can use an accredited supervisor registered by the National Construction Authority. They are construction persons duly registered to supervise such small building projects wise value does not exceed Ksh. 5,000,000.00

Ensure that the project is first registered with the Authority before commencement of the construction.

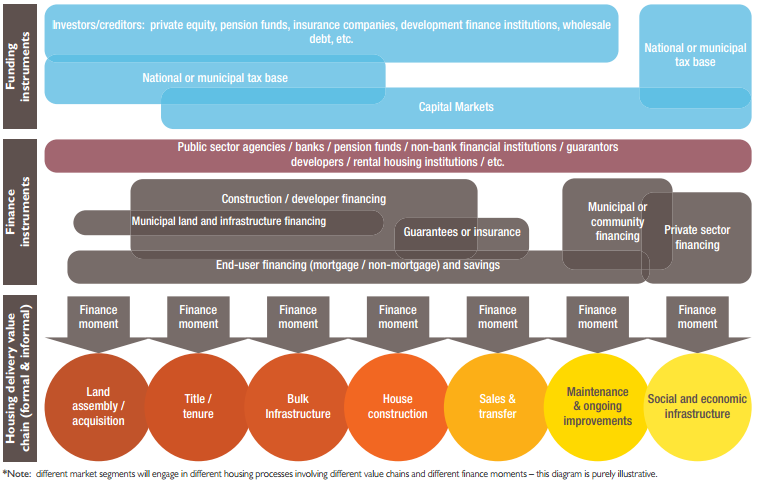

Leveraging the Housing Value Chain To Meet Housing Demand

Housing Delivery Value Chain

It was Archimedes that said, “”Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.”

We have clearly identified in previous posts the pressing needs of our time in providing affordable housing and accommodation. However, in order for us to make a dent on the issue of housing deficit, we must consider all the factors in the housing value chain and leverage those that will cause the greatest impact in provision of housing.

A value chain is a chain of activities that a firm operating in a specific industry performs in order to deliver a valuable product or service for the market.

Today, 40% of the continent’s one billion people live in cities, compared to 28% in 1980. By 2030, this is projected to rise to 50%, and Africa’s top 18 cities will have a combined annual spending power of US$1.3-trillion. The housing market is set to undergo a shift as major players are re-aligning themselves to the new realities of urbanization and the housing deficit.

Definition of Sub-Saharan Africa, according to the United Nations institutions (Photo credit: Wikipedia)

For example, we have seen Housing Finance launch Ezesha Mortgage Product that enables aspiring homeowners access up to 105% financing with a view to cover 100 percent of the property cost, stamp duty and the professional fees. And 5% to cover closing costs with an additional offer of providing a Ksh.500,000 loan for furniture and fittings.

Hard Economic Times and Timers

There is broad recognition that some Kenyans are facing hard economic times, but one must ask themselves whether an easy entry into the Mortgage Industry would translate into meaningful easing of the very pressure that one seeks to escape. If we make it easier for people who cannot afford the minimum requirements and load them with heavier loads, shall we make the initial deterrent disappear? Would it be better to find a solution that addresses both the short and long-term issues?

In the Ezesha Mortgage Product launch, Housing Finance Managing Director, Mr. Frank Ireri said

“One of the major stumbling blocks to home ownership has been upfront payments such as the down payment, stamp duty, valuation and legal fees, which account for about 18 percent of the property cost.”

This brings me to my point.

The Housing Value Chain.

What are the other “stumbling blocks” to home ownership? Can they be turned into Stepping Stones?

You see, we live in a world where a basic human need like housing is becoming a man trap. Let me explain. If you are struggling to come up with a house deposit, could it be a sign that you will struggle with the Loan Repayments? Is the main thing Home Ownership or Ownership of you as the lucrative asset? If you are getting the land, the house, and the furniture on loan, you must be a NINJA. Related Read: Why The Idea of Taking a Mortgage in a High Interest Regime Is a Terrible Idea

What am i trying to say? There is more to home ownership than Finances. Here is How To Think Outside The Box

Robert McGaffin, director of the Housing Finance Course for sub-Saharan Africa at UCT’s Graduate School of Business (GSB) recently said that, “Finance products must match the needs and circumstances of the target population and need to be delivered in a viable manner. The recent global financial crisis and the unsecured credit crisis in South Africa highlight the dangers of poor lending practices, unsustainable business and funding models.”

The idea of the value chain is based on the process view of organizations, the idea of seeing a manufacturing (or service) organization as a system, made up of subsystems each with inputs, transformation processes and outputs. Inputs, transformation processes, and outputs involve the acquisition and consumption of resources – money, labour, materials, equipment, buildings, land, administration and management. How value chain activities are carried out determines costs and affects profits.

— Cambridge University: Institute for Manufacturing (IfM).

Sorting out the top structure financial constraints alone will not solve the housing challenge in Sub-Saharan Africa. Whether governments and institutions succeed in meeting the rising demand for houses and housing finance products in Sub-Saharan Africa will depend on the strength of each link in the housing value chain, that is:

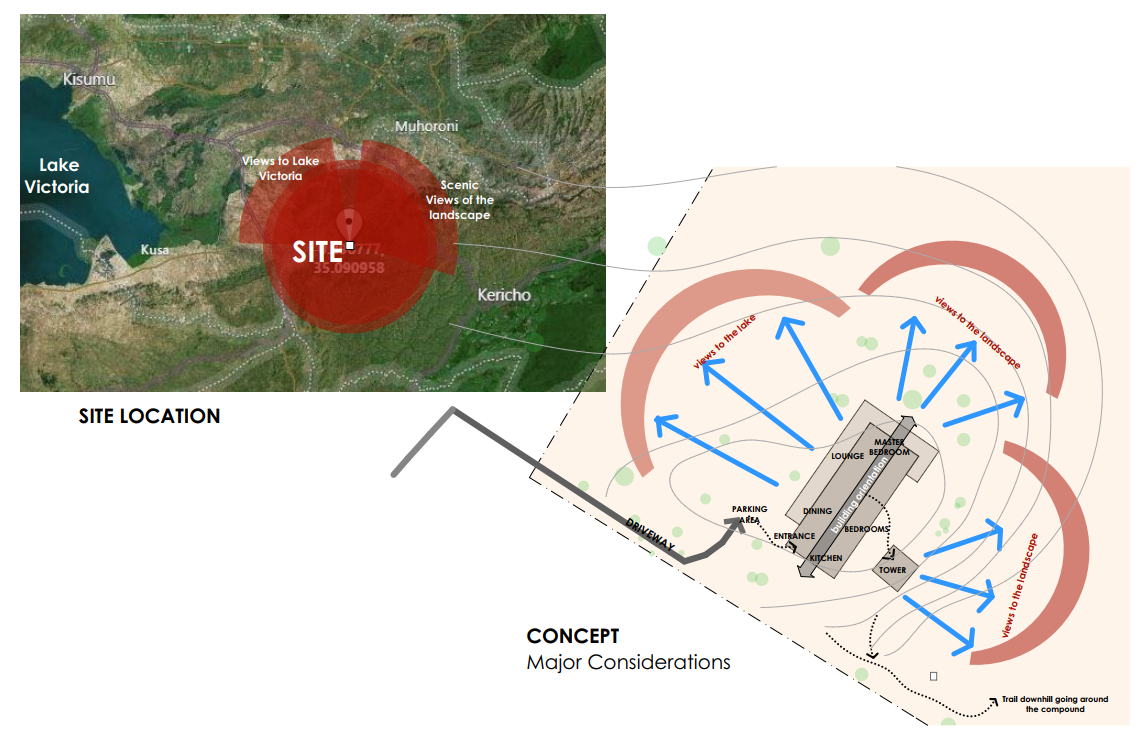

- Land : Can we leverage land through co-operative ownership? Would it be better to develop further from the City? Can we consider housing other than “Residential Units” e.g. Owning Tourist Facilities that would generate Revenue for home owners?

- Property rights,

- Infrastructure,

- Development rights,

- End-user households/Home-Owner,

- Investment, and

- Management.

Of all these things, the potential home-owner is the most important element in the Value Chain.

Housing Finance has made a very impressive move that will help us leverage finance, but we must move with speed so that we bring down the Cost of Housing such that even if someone is signing up for a 105% Mortgage, they are signing up what will not choke them later. We must fuel sustainable growth and not just dumb growth where we shift the wealth on the balance sheet without Creating New Enduring Value.

This is also a call to the other major players in the Housing Market to leverage their skills and expertise to enable the family of man solve the housing deficit problem in Sub-Saharan Africa. Architects, Engineers, Land-Owners, The Government, Political Parties, The World Bank….each and every one of us. We must not only leverage the Financing but also the Thinking, the Architecture (Affordability/Sustainability) and the entire Housing Value Chain.

Last Word

Even as we continually seek solutions to the housing deficit challenge, my sincere advice to you is that when you go to the market, do not let your Signature be an instrument for selling your Soul.

Tafakari Hayo

– Qs. Nahinga David