Category: Business

The Process of Obtaining the Construction Permit and Estimate Durations

What?

The building permit or CP (Construction Permit) is a document provided by a Local Authority to authorize the construction of a new building, or in a situation to amend or renovate an existing approved building.

Who?

The City Council of Nairobi (CCN) has embarked on an ambitious project of automating Construction Permits. This has several Key Benefits to the Industry

How?

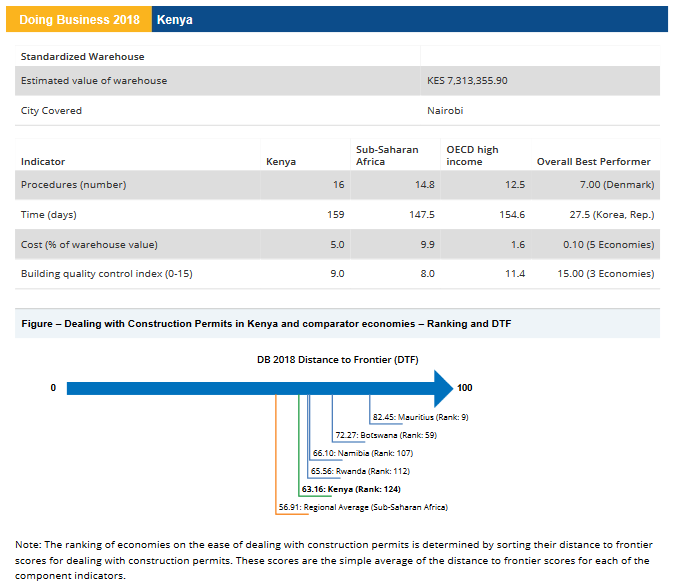

In order to open and run a successful construction business or Undertake a Building Project, it is important for one to understand the process that goes into obtaining business permits. Obtaining a Construction Permit is one of the Key Indicators of the Business Environment in a Country.

Those economies with an easier and less laborious process are deemed to be More Competitive. Singapore, Hong Kong(China), Singapore and New Zealand all have more favorable environments than Kenya. Though Kenya is a regional Best Pwerformer in the ease of obtaining Construction Permits, there is still room for improvement in two aspects:

1. Reduce on time taken from 159 days to Global Best Performer (27.5 Days- Korea Republic)

2. Reduce on number of Procedures from 16 to Global Best Performer ( 7 Days – Denmark)

3. Reduce the Cost as a percentage of Project from 5% to Global Best Performer (0.1% – 5 Economies)

Globally, Kenya stands at 124 in the ranking of 190 economies on the ease of dealing with construction permits.

Generally, the Process is as explained on Page 12 of Doing Business in Kenya Report.

The Procedures for Obtaining a Contruction Permit Are:

- Obtain a Survey Plan from Survey of Kenya – 1 day

- Optain a project report from an environmental expert and submit to National Environment Management Authority (NEMA) – 5 days

- Obtain approval of the environmental impact study from NEMA

- Submit and obtain approval of the Architectural Plans – Up to 45 days. The structural engineer submits all the structural and architectural drawings

to be approved using an online platform httpss://ccn-ecp.or.ke/. The required documents to be submitted are the following:

i. The proposed development;

ii. A survey plan from Survey of Kenya;

iii. Ownership documents

iv. Up-to-date rates payment receipts.

v. Structural plans

The fees are as follows:

(i) Building plan approval fee: 1% of the estimated cost of construction

(ii) Construction sign board fee: KES 25,000

(iii) Application fee: KES 5,000

(iv) Inspection of building le: KES 5,000

(v) Occupation certi cate: KES 5,000

- Submit and obtain approval of the structural plans. – 10 days

- Obtain stamps on architectural and structural plans from the Nairobi City County – Development Control Section.- 1 day

- Apply and received the Project Registration Certi cate from the National Construction Authority (NCA) – 7 days or Less

The following documents must be provided for the registration application

1. Authenticated architectural plans (original)

2. Authenticated structural plans (original)

3. Nema approval (Simple copy)

4. Bill of quantities (Simple copy)

5. contract/agreement (Simple copy) It should be duly signed by both the

contractor and the client

6. Contractor’s registration certi cate (Simple copy)

7. Quantity surveyor’s practicing certi cate (Simple copy)

8. Architect’s practicing certi cate (Simple copy)

9. Engineer’s practicing certi cate (Simple copy)

- Notify the Nairobi City Council of commencement of work and request and receive set out inspection – 1 day

Areas for Improvement:

1. Reduce non-official costs to the process including Diligence of Officers dealing with the process, transparency and elimination of all forms of compromise on the process

2. Increase or consolidate processes that can take place simultaneously

3. The official costs for obtaining the Construction Permits should be kept at a minimum. Setting a goal to reduce this cost will force the Local Authorities to be more innovative and remove costly redundancies in the process.

4. Automation and embracing Click-through-Procedures which can be executed online

Further Reading:

1. Doing Business in a more Transparent World, World Bank, IFC : 2018 PDF ( https://www.doingbusiness.org )

2. Construction Permits, City Council of Nairobi (https://www.ccn-ecp.or.ke/)

What is Affordable Housing?

There is a maxim of law which states,

“The word is not the thing it represents but gets its meaning from its use“

Early this week, I made a request to a company selling “Affordable housing” and I did receive a quotation of Kshs. 66,000.00 per Square Metre! In other words, a simple 3 Bedroom House of 120 Square Metre in floor area would have cost me approximately Kshs. 7,920,000.00 according to my back-of-the-hand calculation using their rates. And believe you me, the Key Player calls that affordable!

In the same period, I was pricing a Bills of Quantities for a four storey house in Kisumu County and the cost came to about Kshs. 44,000,000.

Why this talking point?

There is vagueness that exists in perception of what is “Affordable Housing”. The vagueness creates room for manipulation and uncertainty both at the policy level and amongst the providers of housing solutions.

In this regard, we wish to clarify and propose a more straight way of looking at things.

Affordable Housing is an Expansive Word not Descriptive!

The word “affordable” is so expansive as to include Ministers affording Palaces, Celebrities affording luxurious real estate, Paupers and Peasants affording homes and the like. The Government built the Official Residence of the Vice-President at a cost of Kshs. 400,000,000.00 because it was an Affordable Presidential Housing. Of course, the tax payer could afford it! You see the absurdity of the word Affordable?

The danger is in including every other Tom, Dick and Harry as to permit expansion of the word affordable. The word is as expansive as words like Mammals, Dinner, Furniture and Persons (Which Lawyers say includes natural persons and legal persons). Dinner includes all categories of food that could be served and Affordable includes every human that can be housed each at his/her own cost.

It is a word that requires qualification. One must state whether the house is affordable to the Poor or affordable to the Middle Class or Affordable to those who can afford anything.

Ordinary Sense of the Word

In the ordinary sense, it means less expensive and reasonably priced. It comes from the word “afford” and “ability” which means “manage to buy or maintain; have enough money (to do something)”. We can therefore state that the word “Affordable Housing” includes all classes of people and the choice is left to the beholder on whether the price is fair or on whether they have capacity to buy and maintain.

Since society is divided into two distinct classes that are shifting and intermeddling, that is the poor and the rich. A descriptive word for a House Type benchmarked on Income or Financial Capacity cannot be left to be Expansive! We should say we have 3 or 4 types of broad categories of house types:

- Affordable Public Housing like the VP’s Home, Prisons and Kibera Slum Upgrading Units which our taxes can “Afford”

- Low-Cost Housing

- Middle-Income Housing and

- Luxury Housing

The houses our fathers and mothers lived in as Maasai Domes, Rammed Earth and Makuti thatched houses were Affordable Houses! Half the population does not know what the Building Industry means when we say we provide “Affordable Housing”. We live in a world where strings of Propaganda and Advertising create endless illusions.

I think the time for blanketing every other structure as an “affordable” housing is up. Where are the real Architect-Citizens who can offer real solutions?

However, I must admit this is a thorny issue. We have among us the rich who pose as the poor (Kings on barefoot) and the Poor who pose as the Rich (Footmen on Chariots). Between the two classes, an endless debate and struggle!

Whatever the case, something needs to be done to address the issue of current high market prices and few choices for home buyers.

What are your thoughts?

– Qs. Nahinga

Why the Idea of Taking a Mortgage in a High Interest Regime is a Terrible Decision.

This Four Part Knowledge Series on Mortgages is based on a recent Twitter Mortgage Thread. You can comment on it and interact with me in Real Time Here.

Part A. Unsustainability of a Mortgage:

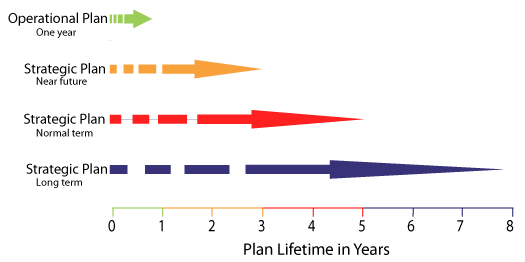

a) Unreasonable Terms: Under our interest rates regime and volatile market, the question, “Should i take a mortgage?”, “Is up there with, “Is there Life After Death?”. The ideal strategic planning timescale is 3 to 5 Years. How people convince a mere mortal to take a 25 to 30 Year Mortgage is a Mystery!

Typical Planning Timescale

The planning period is important because it is an indicator of the Exit Plan. For example, The Mombasa-Malaba Standard Gauge Railway loan from EXIM bank has a 2% interest per annum with a grace period 7 to 10 years. Commercial loan has similar periods. It is also interesting to note that when you compare Mortgage and Life Spans, you find that the life expectancy at birth in Kenya is 63.52 while that of a cheetah in the wild is 10 to 12 years. This implies that Three generations of Cheetahs would have been born before you finish paying that mortgage. And technically half your “expected life.”

b) Hidden Costs: “Hidden” Mortgage Costs Can exceed 10% over and above the Mortgage Rate! When signing up, you may not be aware of Additional Charges. Beware, Hidden Mortgage Costs Can exceed 10% and Most of Our Banks don’t make full disclosures!

Examples of Hidden Mortgage Costs are:

- Valuation/ Realtor Fees can be as high as 3%

- Account Opening/ Origination Fees – Between 1 to 2%

- Booking Fee – You may or may not qualify when you apply

- Cost to register a mortgage and title transfer (4.35% of property value )

- Stamp Duty and Registration Fees Approx. Ksh. 45,700

- Mortgage protection policy premium. – You have to take additional insurance cover.

- Legal Fees for Processing the Mortgage Fees. Will depend on Lawyer/ Bank. Usually non-negotiable

- Property Tax

- Commisions

- Broker Fees

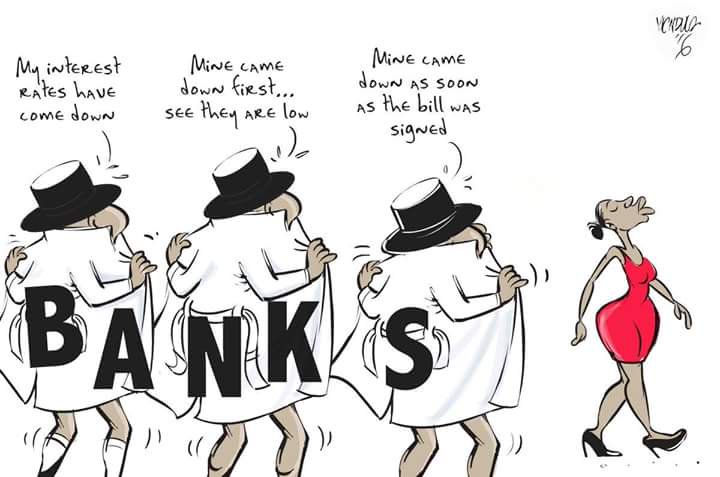

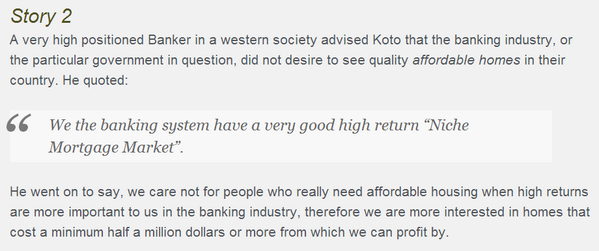

c) Banks are Not Interested In Affordable Housing: It is an Open Secret that Banks are NOT INTERESTED in the Affordable Housing Market for the sake of it unless there is a Killing to be made in fees and hidden charges. According to One Government that spoke to KOTO here:

“We the banking system have a very good high return in “Niche Mortgage Market”.

The Question is, “What is the SIZE of said MARKET in Kenya?” The lucrative Niche Mortgage Market in Kenya is approximately 1%.

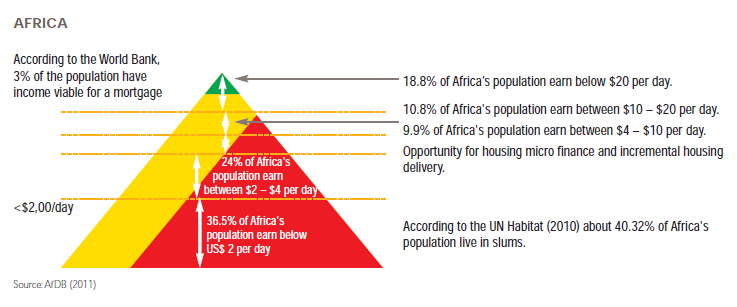

According to the World Bank, 3% of the population in Africa have income viable for a mortgage.

You can say this is a conversation we, the 99%, are willing to have with ourselves. We are not in the “Niche Mortgage Market”.

d) Age Limitations on Mortgages: If you are 35 Years+, remember that a mortgage is a type of loan with a definite repayment period. Typically Loan Maturity cannot exceed retirement age. Since most mortgages are for 25 year terms, soon you will permanently NOT QUALIFY on account of age limitations.

e) Over-Purchasing: When you sign up to a toxic mortgage, you are buying more house than you can afford but over a longer period. Most are Toxic anyway! Technically, That is a bad decision UNLESS your monthly mortgage payment is less than 25% of take home pay.

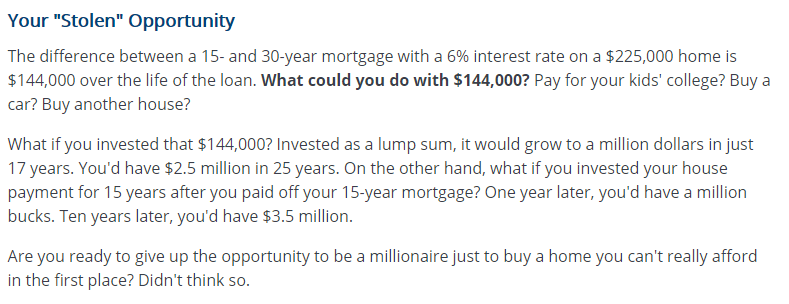

f) Stolen Opportunity!: According to Knowledgeable Experts, A 25 to 30 Year Mortgage Steals Your Future! Blog:Your “Stolen” Opportunity

g) Other Nations started early. We are doing too little too late: It is a bitter fact that we are late on the Home Ownership program. One can almost say that it has been Policy since 1963 that housing should be Un-Affordable! The mere lack of demonstrable effort proves it is. Property Owning was supposed to be on the Transformation Agenda since 1963.

When you consider the work of Other Countries and their Founding Fathers, you quickly learn there was exactly NOBODY to take the Bullet for Us! Nobody actually cared about the question of Affordable Housing or Affordable Mortgages.

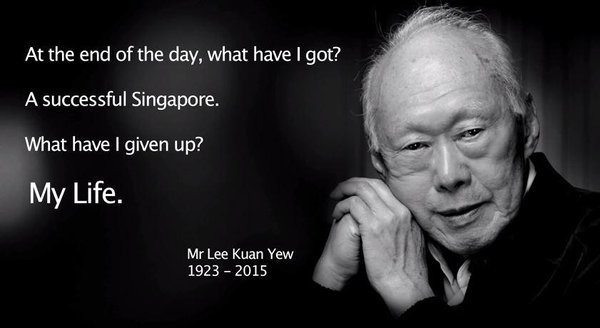

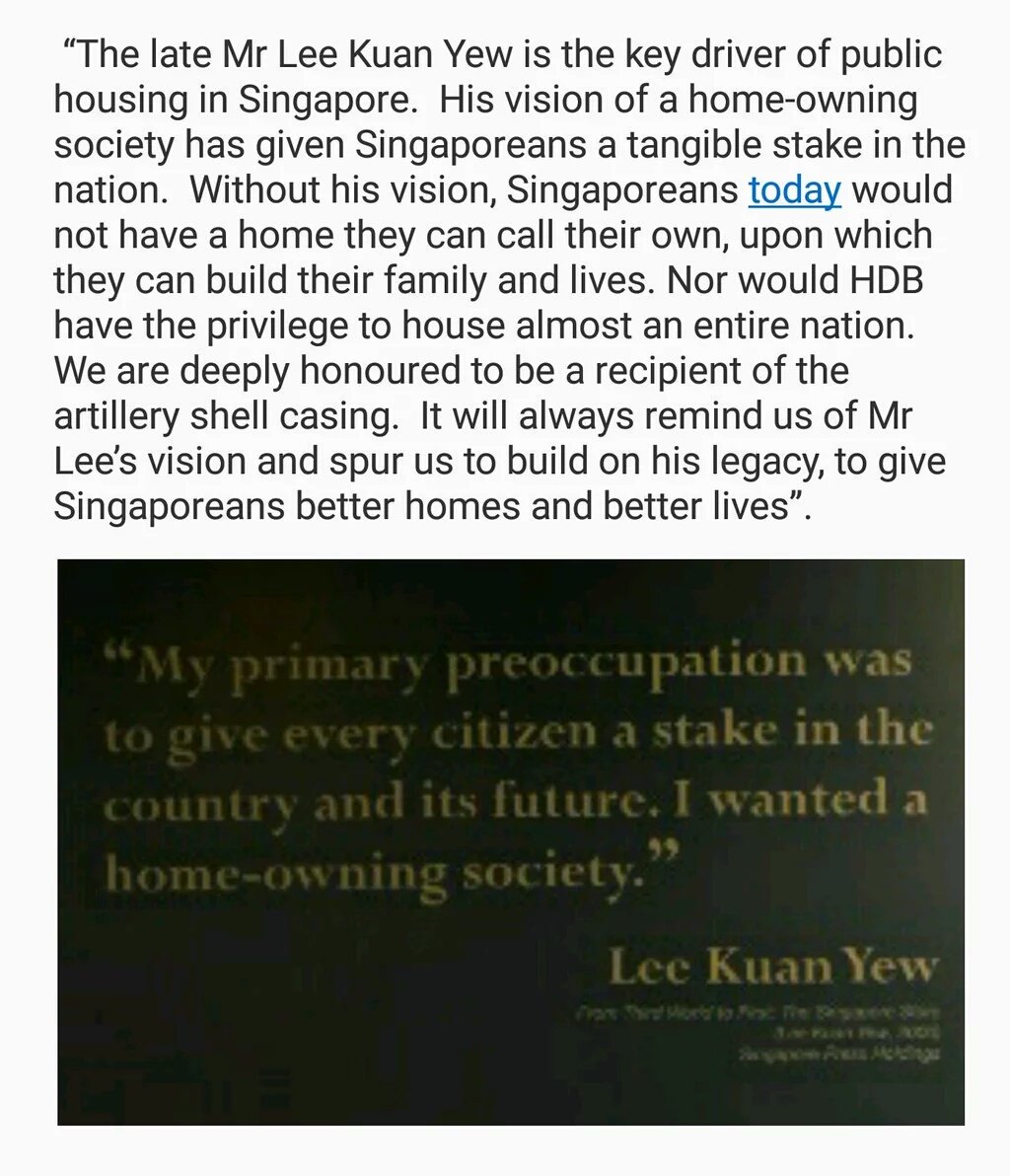

We like comparing Kenya to Singapore during campaigns. It is good to know the vision of Lee Kuan Yew was a 100% Property-Owning Democracy. According to Parliamentary Debates of Singapore Volume 45, Col. 1140, it is recorded:

“Lee said the Government’s aim “is to try and get a unique society set up out of extraordinary circumstances, of near despair, to become a 100% property owning democracy.”

In Kenya, we are held at ransom by the Lands Cartels and the Bankers! There is no Visionary like Lee among the people! Here is a slight preview of Singapore at he Vision of their Founding Fathers:

2. Public Housing in Singapore – Wikipedia Article

End of Part A.

Part B. Seven Myths on Mortgages.

Part C. Seven Reccomended Cures for a mortgage.

Part D. What my friends and Other Experts THINK concerning Mortgages.