Housing as a Verb: The Sense In Building Slowly.

By definition, a verb is an action word. It brings the sense of unfolding series of steps. I would like to borrow this language and relate it to housing.

All the conversation around home ownership has primarily been around buying a fixed product. A House (A Noun). With no action expected on the part of the home owner apart from signing that mortgage agreement or cheque. This top-down authoritarian approach to housing ignores a major player in the equation, the user.

Intellectual Basis: The Freedom to Build

Most buildings cannot be occupied until they are finished. In real life, occupation certificate cannot be issued until the whole building has achieved Practical Completion. However, the question then to ask is, “What is “Completion?”, Can Practical Completion be Achieved In Stages?”

“If housing is treated as a verbal entity, rather than a manufactured and packaged product (noun), decision-making power must, of necessity, remain in the hands of the users themselves.

The ideal we should strive for is a model which conceives housing as an activity in which the users-as a matter of economic, social, and psychological Common Sense-are the principal actors. This is not to say that every family should build its own house, as the urban squatters do, but rather that households should be free to choose their own housing, to build or direct its construction if they wish, and to use or manage it in their own ways.” – Freedom to Build, John F C Turner & Robert Fitchter (1972)

Self-build and The Law

What does the law say about self-build? Is Owner-Building prohibited by the Law? Surprisingly, the answer is partly Yes and No. The National Construction Authority Act 2011 provides in Section 16:

“a person shall not be deemed to be a contractor if the work undertaken— (i) does not incur a cost exceeding such sum or sums as the Board may from time to time determine; or (ii) consists of a residential house for private use, not requiring a structural design.” – See more here.

• How many people can afford a Building Contractor?

• How many people can afford to buy a ready built house (ready to occupy)?

• Most importantly, how many people can afford a housing mortgage today? According to a 2015 survey by Kenya Bankers Association, those who could afford a mortgage in Kenya are only 2.4% of the population.

For a majority of the population, Assisted Self-Build(ASB) (Also called Do-It-Yourself) is the only viable option out if the dream of Home Ownership is to become a reality. In this regard, Building Slowly is the Common Sense Solution!

The Reality

Admit it! Most people don’t have to have all the money to build their own “dream” house. And this is perfectly OK if you understand where to put the brakes and how to proceed to completion.

Nobody ever has enough of everything on short notice. That is why humanity has embraced the concept of growth. Countries aspire to be developed or middle-income after certain number of years. They tell us, “Rome was not built in a day,” but seldom do we hear stories of victory by ordinary people building their life one step at a time. We are inundated with messages of “Utahama Lini” as if housing is an emergency. It is not unless it is!

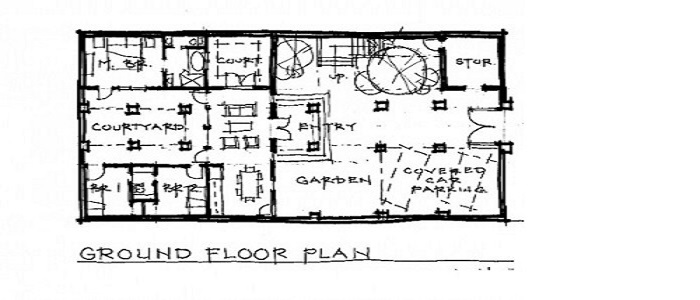

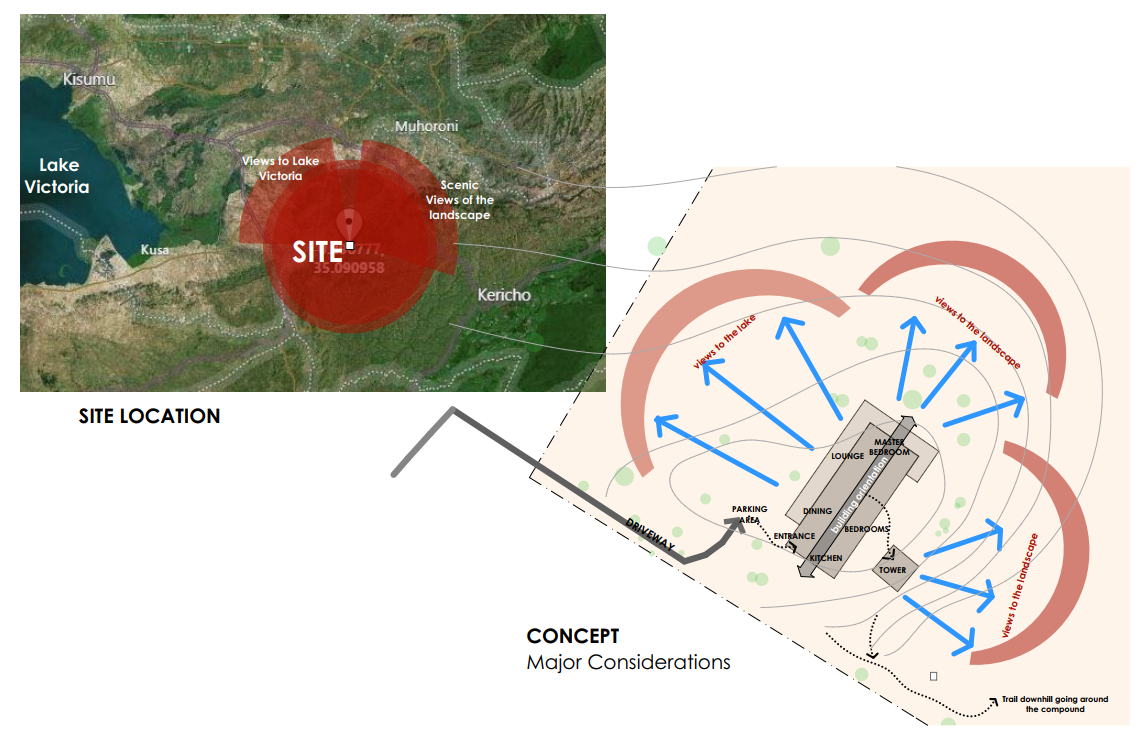

Real Life Example: Application of Build Slowly

In February 2010, a magnitude 8.8 earthquake hit Chile, killing approximately 500 people and destroying 80% of the buildings in the town of Constitución.

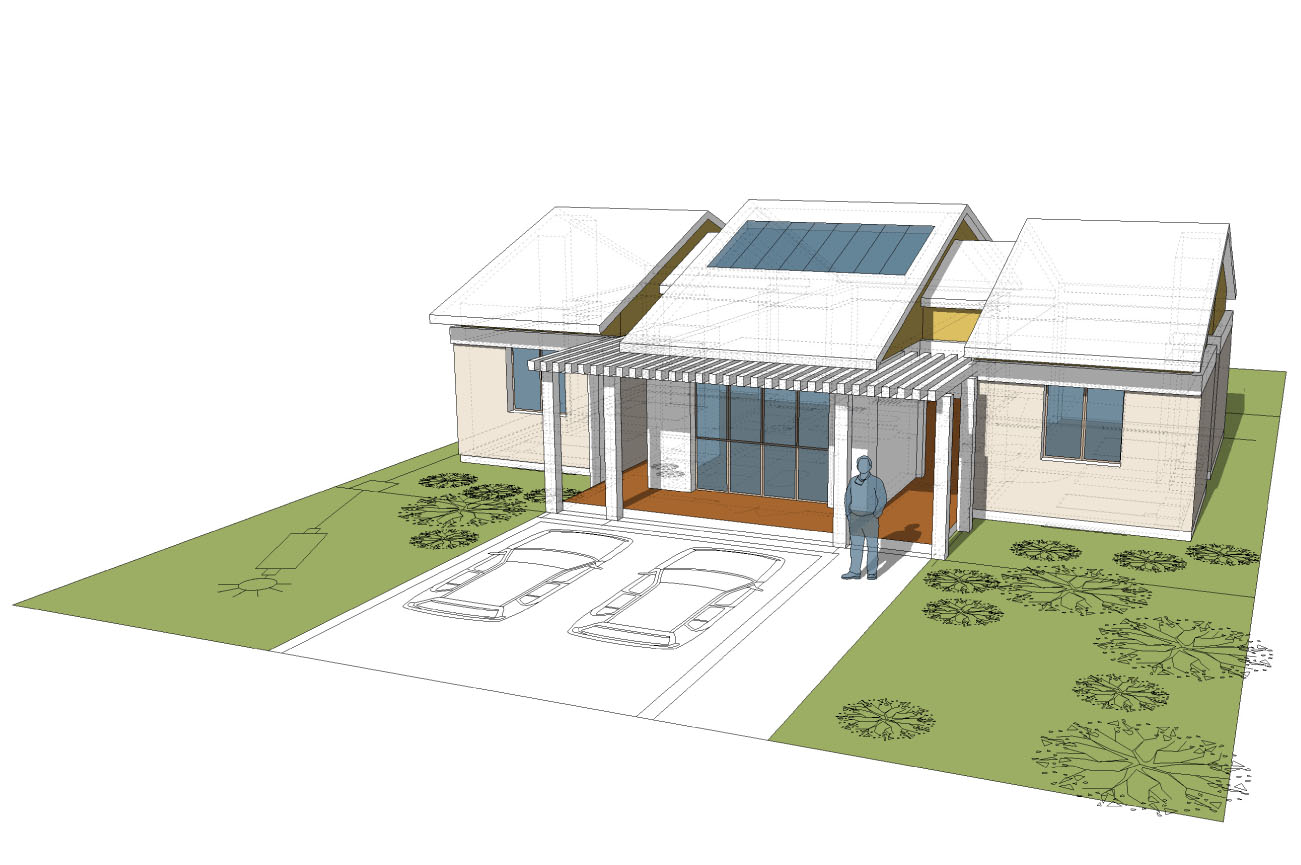

An award winning firm of Architects called Elemental reconstructed the homes named, “Villa Verde”, housing complex with more than 480 sustainable homes for the victims of the earthquake.

According to 99% Invisible, As part of the relief effort, an architecture firm called Elemental was hired to create a master plan for the city, which included new housing for people displaced in the disaster. Elemental built for the people Half-a-House with one half of the house ready to be moved in and the other half, just a frame with an empty space ready to be built up when the owner grows wealthy.

Incremental Building: Villa Verde by Elemental, Chile

This is exactly the idea of a House as a Verb!

As you prosper, then you can have Add-Ons to the initial fabric or structure of the house. In this case, the house is never seen as a complete project but an unfolding expression of the ways, means and creativity of the owner.

If we can start looking at housing from this perspective, all the pressure that one must build NOW and Occupy the Entire House immediately, evaporates.

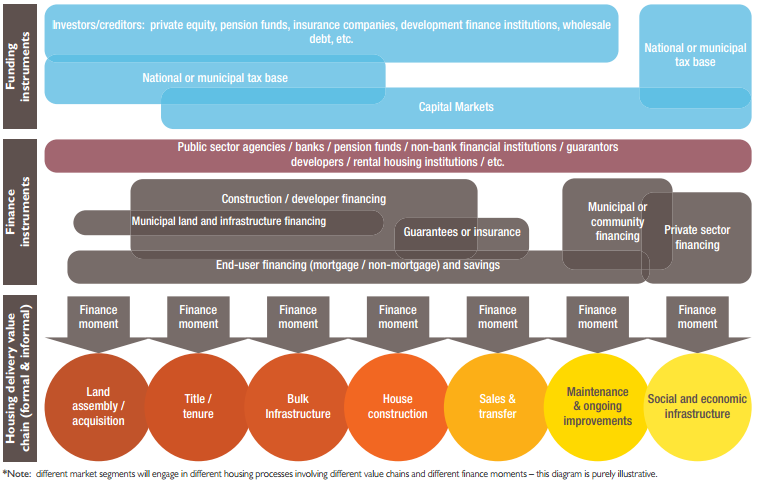

The technical term for this is called Site and Services Schemes or Incremental Building.

Advantages of Incremental Building:

- Improvement and Modernisation of the units can be done at a later stage.

- The fabric of the house can evolve to reflect the achievements of the owner.

- As the expert, the Design-Build contractor can transform into providing affordable housing solutions or a series of Packaged Deals which any would-be home owner can pick and assemble incrementally with Add Ons as their fortunes improve. This is housing as it should be.

Are we looking at a New Opportunity of User-Controlled Housing?

Does it have potential to become the new vehicle of personal, family and social growth?

If we think of Housing as a Verb, we allow the People to Shape their Destiny. This way, we can build a better future together. …..to be Continued.