To attain knowledge add things every day. To attain wisdom subtract things every day. – Lao Tzu

Why a Cost Editor?

“Editing- which involves the strict elimination of the trivial, unimportant, or irrelevant – is an Essentialist craft.”

Everyone who reads a newspaper that has a lousy editor knows the feeling of being wasted.

But seldom do we reflect on the role of a good editor. A good editor leaves everyone focussed on the main issues of the story without being bogged down in unnecessary details.

When it comes to construction works, a Quantity Surveyor plays the vital role of a Cost Editor because he has carefully trained his/her eye and mind to see details. Here are 7 ways this can happen, leading to savings both in time, cost and bringing out the Lead Story in your Project.

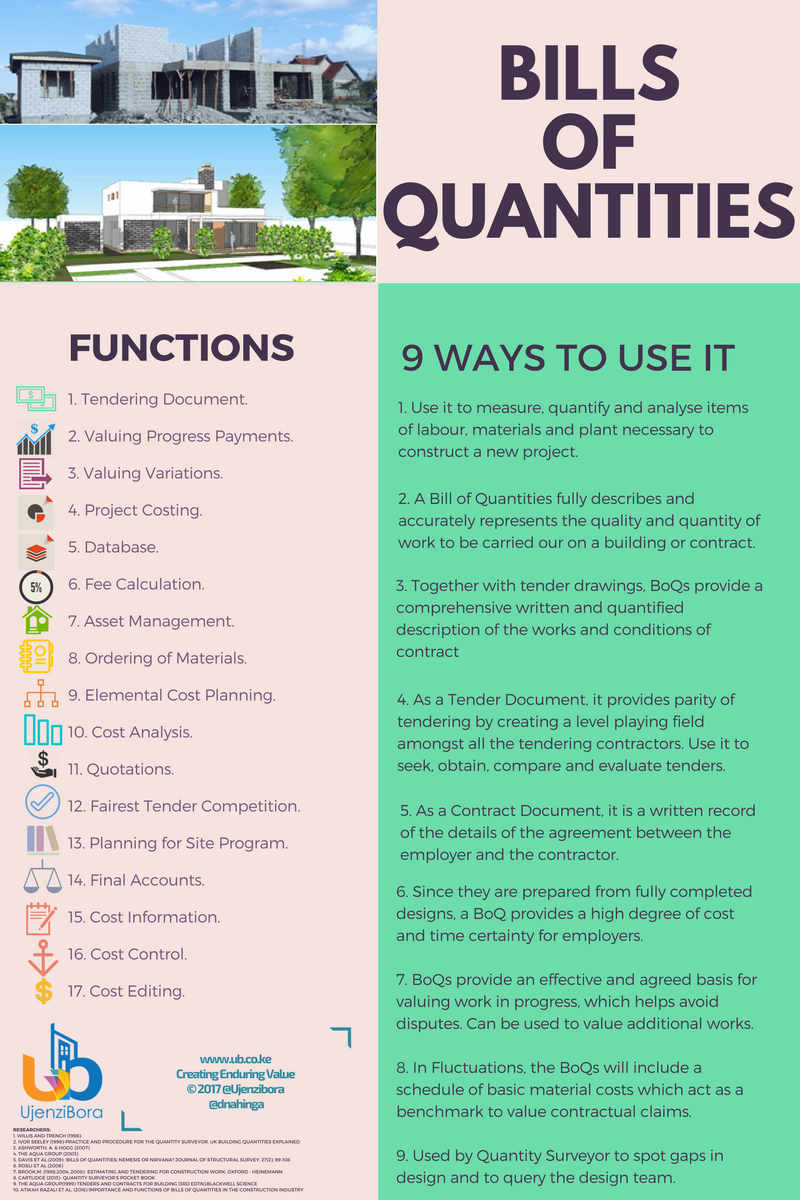

According to Miliken, The Bills of Quantity is a fundamental instrument which has existed and developed over 300 years. It is to the discerning investor, what a pen is to a Copy editor.In my experience as a Quantity Surveyor, Bills of Quantities are entirely justified where the anticipated savings outweigh the fee charged to produce them. The role of the Quantity Surveyor as a Cost Editor in both big and small construction projects is emerging as an exceptional and an indispensable skill. Here are 7 Ways Why!

1.0 Elimination

A book editor or a film editor makes it easier for the reader to keep an eye on what is important. They do this by eliminating everything but the elements that need to be there.

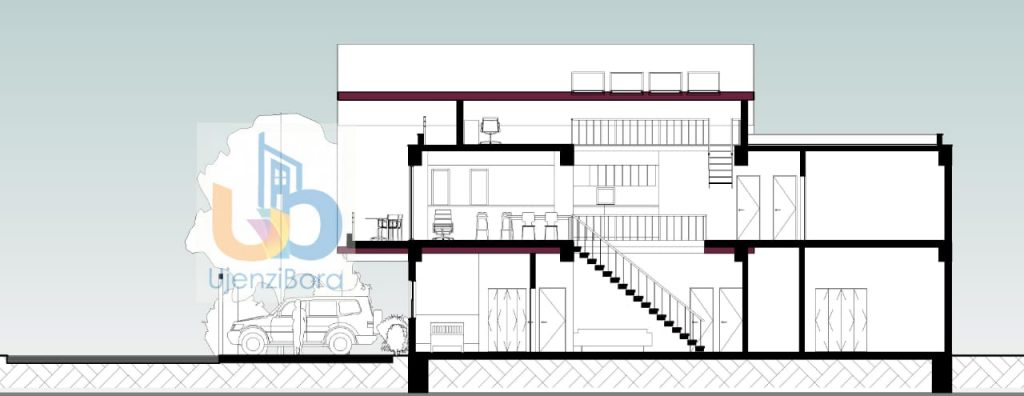

A Quantity Surveyor as a Cost Editor can help your project by reviewing both the design and rationale for inclusion of certain elements. For example, in a recent building project, we proposed removal of 7 Square metres of corridors and saved the client 245,000 Shillings. The house worked just fine without the overdesign of circulation space. This was not apparent to the Architect of the Project.

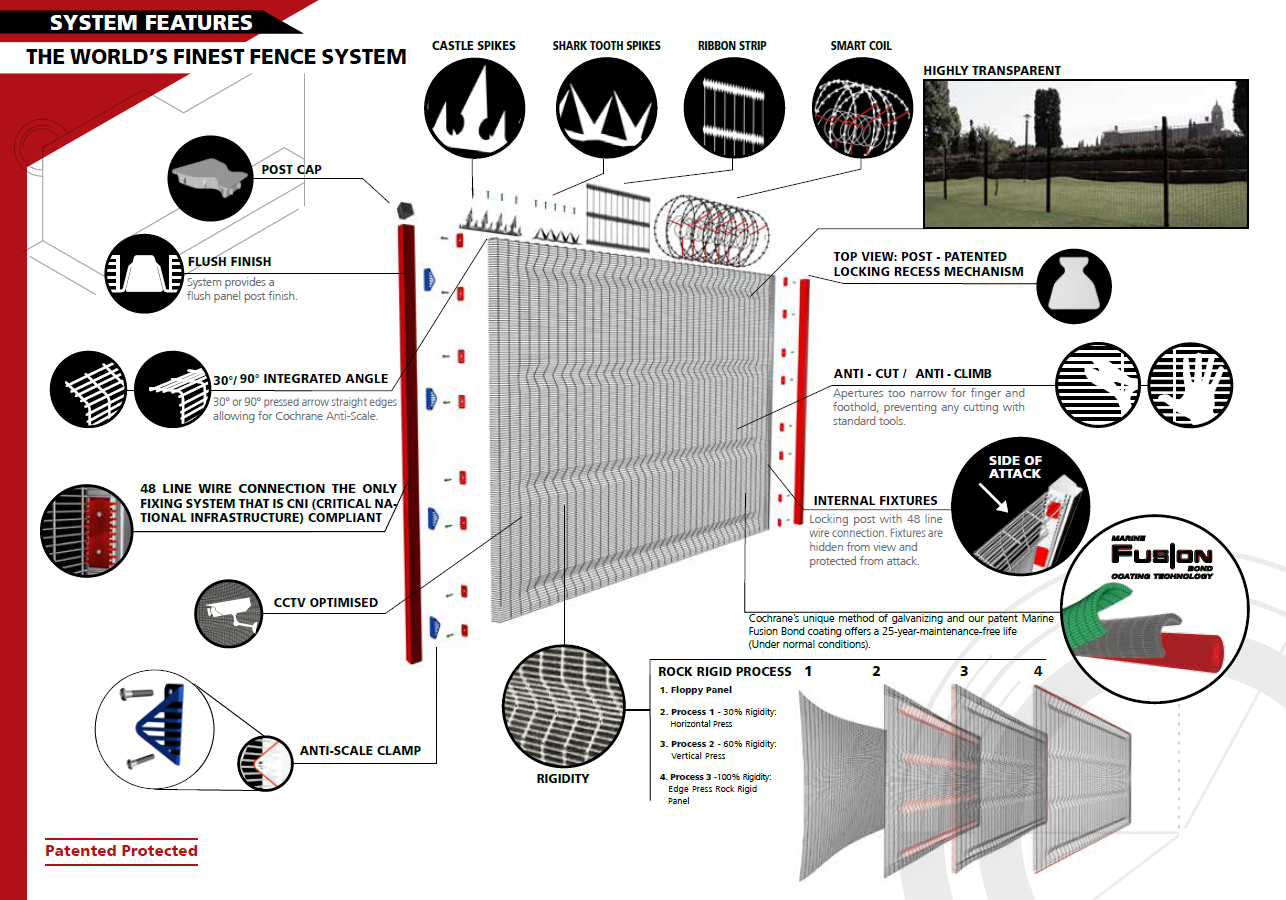

2.0 Providing a Measurement Tool

A bill of quantity is a measurement tool. It captures the Lead Story of the project. It has brief description of every part of the proposed project. A recent Study revealed that where contractors are given a chance to estimate the cost of a project without a Bill of quantities, they increase costs by a factor of 10% to take care of Quantities Risk. In that sense, the very act of having a Bills of Quantity in your project can save you up to 10% of the cost of construction.

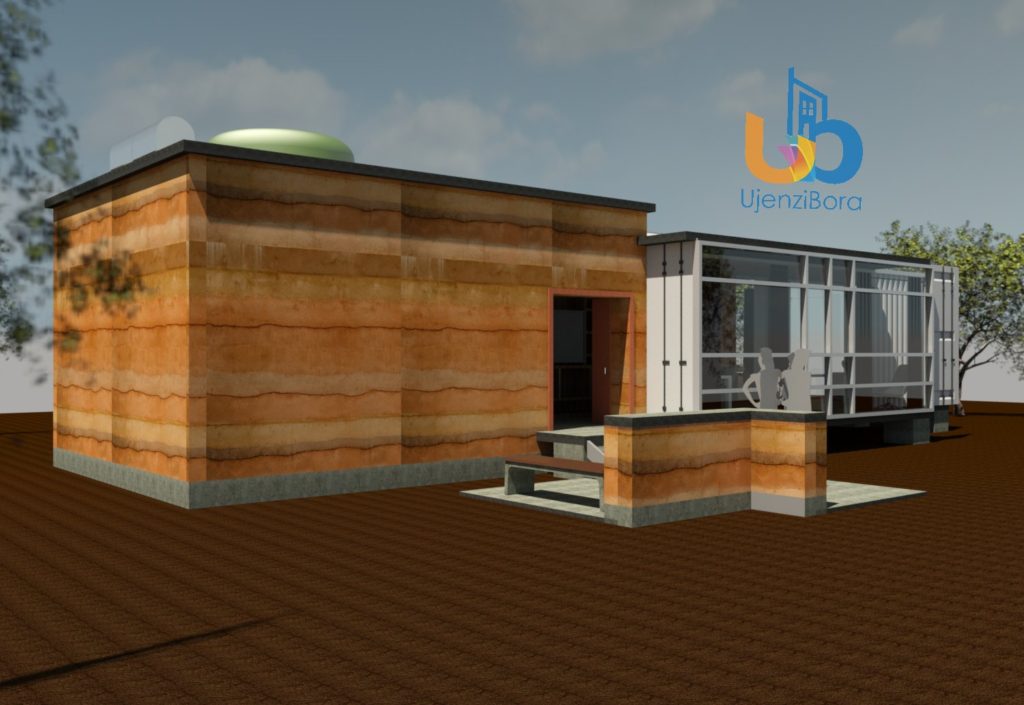

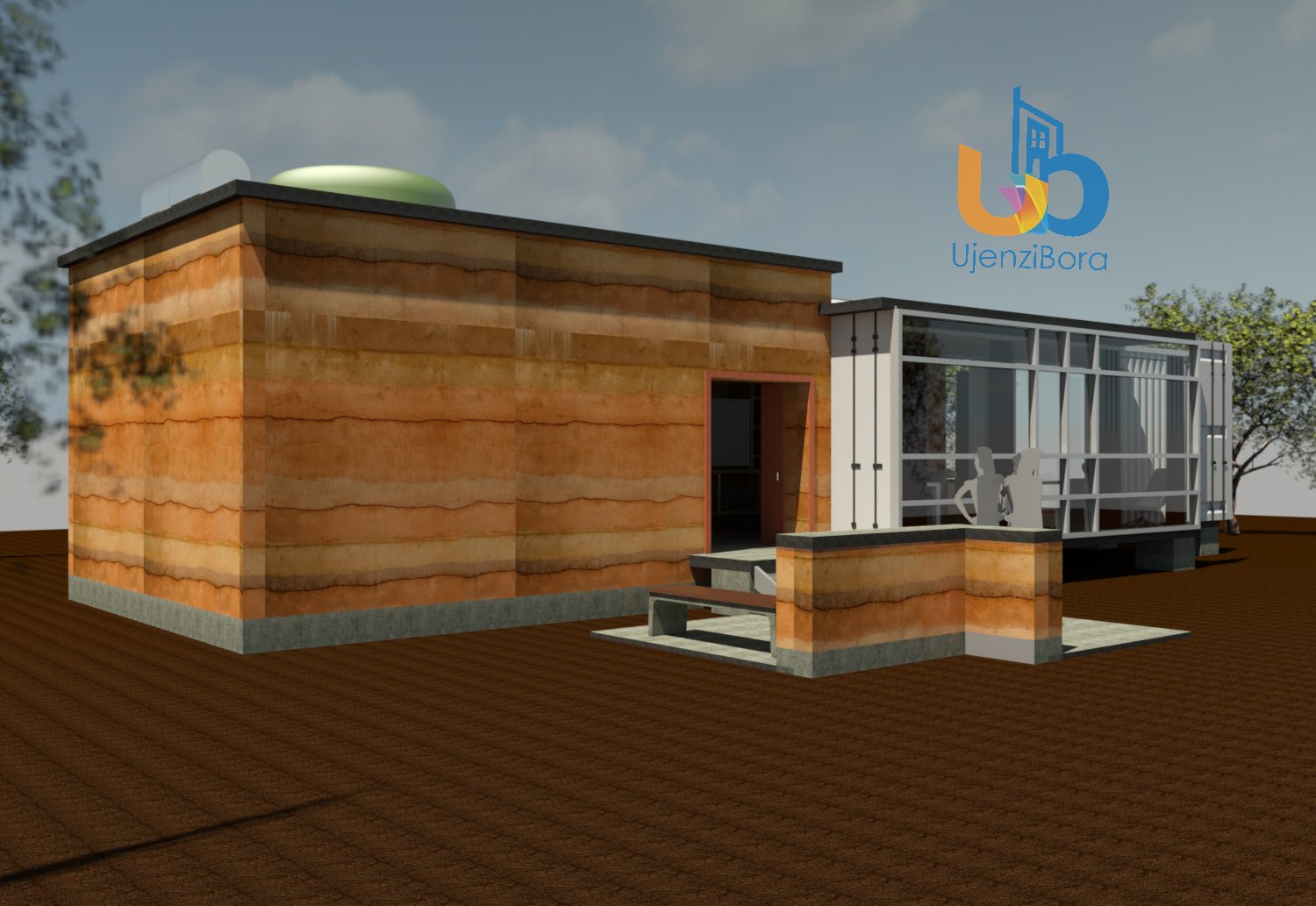

3.0 Substitution

A Quantity Surveyor prepares a Bill of Quantity for infrastructure projects (Building or Civil). A bill of quantities is a document used in tendering process which includes the materials, parts, and labor with respect to their costs. During this process of preparing the Bill of Quantities, a QS can propose substitution of the materials, methodology for construction and more affordable alternatives thereby leading to significant cost savings.

4.0 Prioritizing or Phasing.

When an author has a very long story and the publication does not have enough space, the editor decides which parts of the story to cut and publish later. In building construction, we call it Phasing a project. To achieve this, a Quantity Surveyor asks questions, listens to all the consultants (Architect, Engineer, Client Contractor et cetera), and connects the dots in order to distinguish the essential few from the trivial many. As a Cost editor, he can propose budgetary allocations that match the current financial constraints of the project. He can also help the Client to prepare cash-flow projections and phasing of the project!

5.0 Making Trade-Offs

A book writer may have many characters they want to fit in a story. They could also have many plots, twists and turns. Without a Copy editor, the whole storyline can get lost in the confusion of trying to include everything. A great editor asks, “Will this character or plot twist or detail make it better?”

The true value of a Quantity Surveyor is in helping the Client and the project Team re-discover what really matters in the project within the time, cost and quality expectations. In this case, they can suggest meaningful trade-offs, substitutability of building materials and best practice from past projects.

6.0 Time Estimation using The Labour Constant.

The Contractor’s prices for the various work items in the Bill of Quantities reflects the amount of time the estimator has allowed to complete each unit of work. This is refereed to as a Labour Constant for the particular item. It is easy for the Estimator Quantity Surveyor to help the project team calculate how long it will take to complete both individual work items and the entire project. This can help the project team to design a planning framework and formulate programmes for constructing the building.

7.0 Identifying Gaps.

A book editor or a film editor fixes gaps which break the main story line.

One of the major benefits of employing a Quantity Surveyor to measure is that, during the process of preparing Bills of Quantity, a QS will often spot gaps in the design information and will query the design team as to what is missing , will press then to finalise the outstanding information or suggest fixes.

Lastly, In the words of French writer and Poet, Antione de Saint-Exupery, “Perfection is achieved, not when there is nothing more to add, but when there is nothing left to take away.”

References:

1. McKeown, Greg. Essentialism: The Disciplined Pursuit of Less Ebury Publishing.

2. Cunningham, T. (2016) The function and Format of Bills of Quantities: an Irish Context. Report prepared for Dublin Institute of Technology, 2016.